When a person dies, emotions and obligations intensify for the people he or she loved. After a death, everyone is grieving, albeit differently, and facing the prospect of a long journey through loss. On top of the painful feelings, there are dozens of decisions to make. There’s a memorial to organize. There are arrangements to make with the mortuary. There may even be life-changing, long-term logistics to consider, such as the financial impact of losing a breadwinner or the relocation to a more affordable neighborhood.

Into this context enters probate — the legal process of distributing the deceased person’s property among survivors — and things often get messy. You probably know families that have been torn apart by this process. You may have even experienced this in your own family. The probate process can and does have damaging impacts on relationships, though not always. Still, it’s prudent to get familiar with probate — what it is and how you can avoid it. Taking ownership of your estate plan allows you to control how your assets are handled when you are no longer around to manage the process.

Table of Contents

What is probate?

Broadly, probate involves the court valuing an estate, ensuring its debts are paid, and assigning someone the task of distributing the property remaining in it.1 Whether or not the deceased person left a will, the process is pretty similar, although the distribution of assets is differently determined.

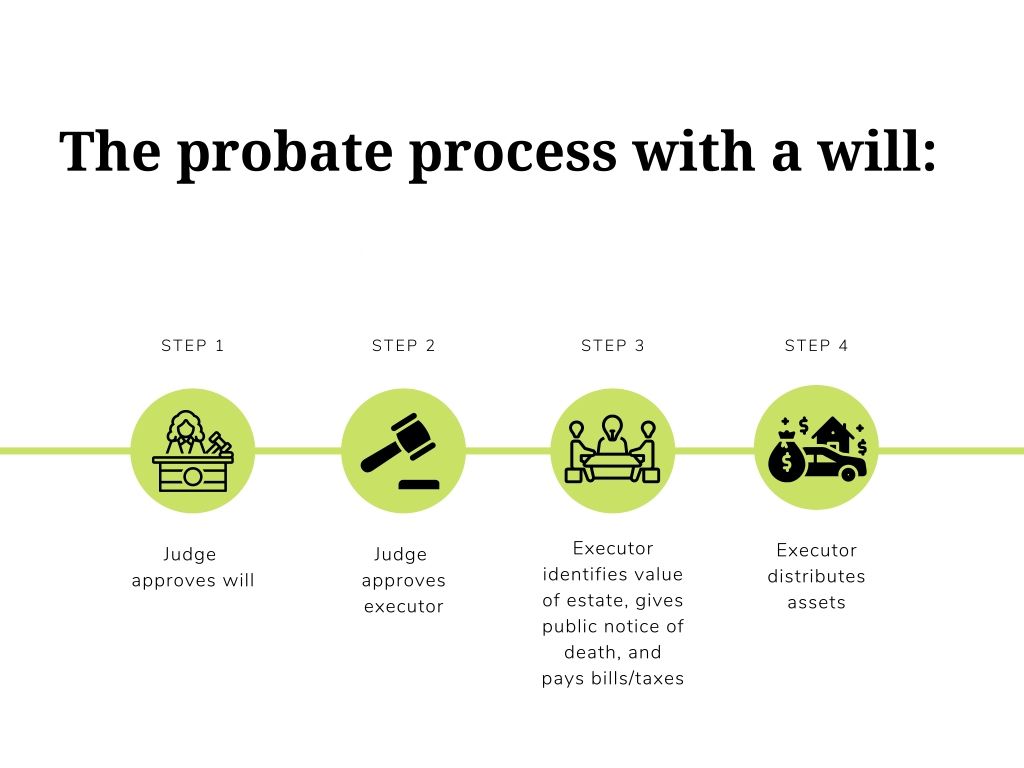

If the person did leave a will, the will has to be authenticated. Essentially, what this means is a judge has to confirm the will was signed, dated, and drafted properly.2 The judge also has to approve of the executor named in the will — the administrator of the estate, whose job is to ensure the deceased person’s wishes are honored — before the work of probating the estate can begin. The executor is responsible for identifying all the assets in the estate, giving public notice of the death, and paying bills and taxes owed by the deceased person.

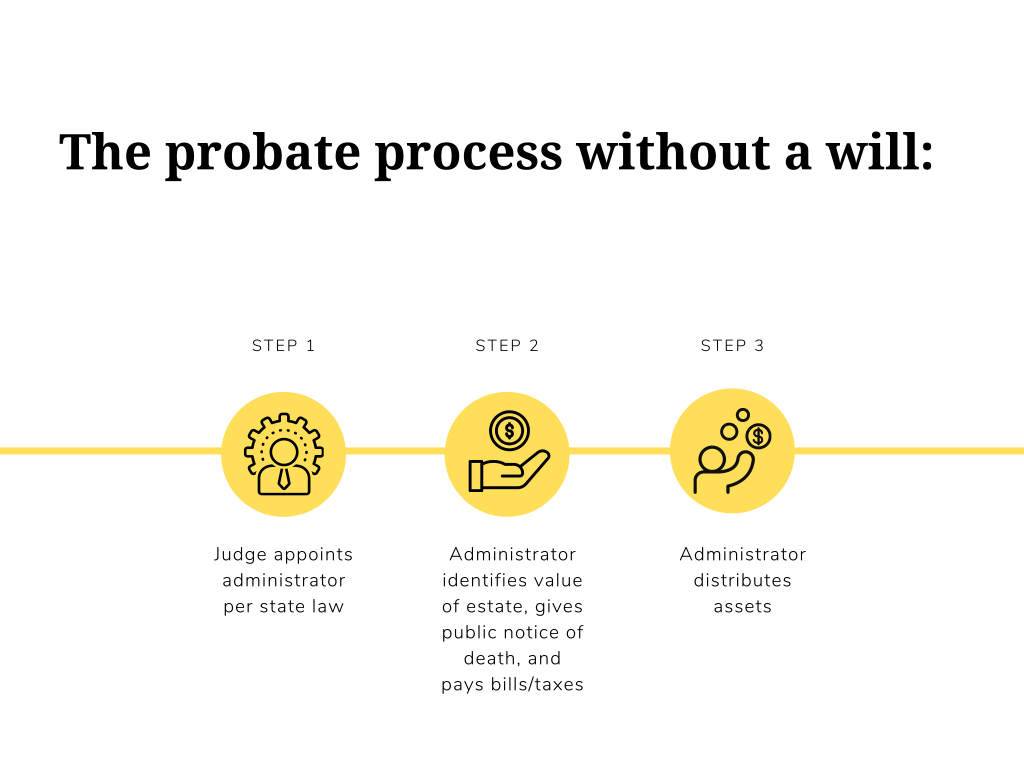

If there’s no will, the judge will appoint a personal representative, also known as an administrator. State laws determine who becomes the administrator; often, this is a surviving spouse or child.3 This person bears many of the same responsibilities as the executor. In some states, an administrator is required by law to purchase what’s called a probate bond — an expense that’s later reimbursed if the person acts with integrity in doling out the assets of the estate.

Once the estate’s obligations have been met, the executor or personal representative oversees the distribution of the estate. If the deceased person didn’t make a will, the court determines who gets what. Formulas and processes for making this decision vary by state. Most states will distribute the property to the deceased person’s immediate family.4 Courts in some states divide property 50-50, or in half; others consider a range of factors to equitably, or fairly, distribute the assets.5

Five ways to avoid probate

Probate, as you either know or can imagine, can become a hotly contested process. It can take a lot of energy, effort, time, and money.6 Some probate proceedings are quick and easy. Many are not. The good news is there are ways to protect the people you love from having to deal with a court proceeding at the same time as they’re grieving your death. Here are some of them:

1. Small Estate Affidavit

If you have a small estate — the definition of small varies in each state; for some, it’s less than $15,000 and for others, it’s less than $200,000 — you can avoid the probate process entirely. To find out what your state considers small, check out the table we created here. Often, administering a small estate just involves filling out a form that allows you to collect assets from third-party institutions, including banks.

2. Distribute Estate Before Death

Another simple way to avoid probate is to give away what you own before you die. This way, you can be sure your decisions aren’t challenged, either by a judge or by the people you love, when you’re not around to explain or defend them.

3. Make Financial Assets Payable on Death

You can also name beneficiaries on your bank accounts, retirement accounts, stocks, bonds, brokerage accounts, and insurance policies. In legal language, this is known as making your accounts Payable on Death (POD) or designating them as Transfer on Death (TOD). What this means is that the money in your accounts will go directly to the people you name rather than through the court. The process is simple. To make a bank account or retirement account POD, you can fill out a form at your bank.7 You can make stocks, bonds, and brokerage accounts POD by requesting a form from your stockbroker or the company in which you own shares.8

4. Joint Ownership

Another way of avoiding probate is owning your assets jointly with someone you trust to carry out your wishes after your death.9 A lot of people think you can only jointly own property and accounts with a spouse, but this isn’t actually the case. There are specific arrangements for married couples, but you can also give someone else a right of survivorship, or the right to take over your portion of jointly owned property.10

5. Revocable Living Trust

Perhaps the most common way people avoid probate is by setting up a revocable living trust. A will has to be probated by the court, which requires time and money. A trust does not. When you set up a revocable living trust, you name a trustee. This person is legally obligated to use whatever assets you put into your trust for your benefit or according to your wishes. While you’re alive, you retain the right to revoke the trust. But if the trust is active when you die, the ownership of the property in it still belongs to the trustee. This means it’s no longer part of your estate, and thus doesn’t need to be probated.11

Estate Planning Assistance

Most people don’t want to think about dying or making a plan to protect the people they leave behind. The prospect can be scary and sad. But if you know anyone who’s been burned by the probate process, you know that planning your estate can be a thoughtful gift to the people you love and will, unfortunately, leave behind. Check out our Estate Planning Checklist, including a database of official forms, with templates for wills and living trusts, to begin thinking about your estate today.

Sources

- https://trustandwill.com/learn/what-is-probate

- https://executor.org/probate-court/

- https://www.courts.ca.gov/8865.htm?rdeLocaleAttr=en

- https://www.investopedia.com/terms/p/probate.asp

- https://www.justia.com/family/divorce/dividing-money-and-property/

- https://money.cnn.com/retirement/guide/estateplanning_wills.moneymag/index7.htm

- https://www.findlaw.com/estate/probate/avoiding-the-probate-process.html#:~:text=setting%20one%20up.-,Gifts,be%20thwarted%20by%20unseen%20circumstances

- https://www.finra.org/investors/alerts/plan-transition-what-you-should-know-about-transfer-brokerage-account-assets-death

- https://www.nerdwallet.com/article/investing/what-is-how-avoid-probate

- https://www.findlaw.com/estate/probate/avoiding-the-probate-process.html#:~:text=setting%20one%20up.-,Gifts,be%20thwarted%20by%20unseen%20circumstances

- See Previous