An inheritance tax is, as its name suggests, a tax on what you inherit. The federal government doesn’t treat any assets inherited when someone dies as income, but five states do. If you live in one of these states and your parent or someone else leaves behind a will that names you as a beneficiary of a substantial amount of money, you might have to pay a tax on what you receive. Books about tax matters refer to this particular tax as “the last twist of the taxman’s knife.”1

The history of the inheritance tax stretches as far back as Ancient Rome. There was evidence, on sheets of papyrus, that the emperor Augustus imposed a 5 percent tax on large inheritances, though it did not apply to close relatives of the deceased.2 This exemption for close relatives still applies in most states that charge inheritance tax. How much you pay in tax depends not only on the size and nature of the asset you inherit, but also on your relationship to the person who gave it to you.

Estate Vs. Inheritance Tax

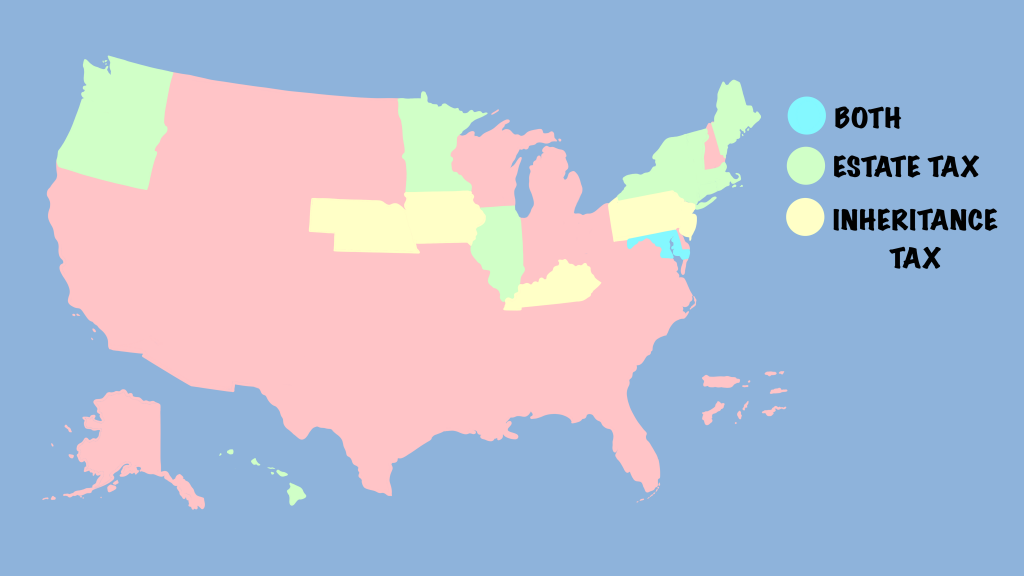

An inheritance tax is different from an estate tax, though both are known as “death taxes.” The federal estate tax kicks in when an estate, as of 2021, measures at least $11.7 million. Eleven states also have their own estate taxes that take effect at varying amounts.3 An inheritance tax is paid to the state by the beneficiary of an inheritance.

Most states in the United States have, in this century, abolished the age-old inheritance tax. But if you live in Kentucky, Maryland, Nebraska, New Jersey, or Pennsylvania, you can expect to pay tax on your inheritance. Rules and rates vary by state. In this blog, we’ll give you a quick rundown of each.

Kentucky

Immediate family members of the deceased do not pay inheritance tax in Kentucky. Anyone else can expect to pay a percentage ranging from 4% to 16%, depending on the size of the inheritance. The only property exempt from Kentucky’s inheritance tax is property in another state. Gifts made within three years of the death can also be taxed, if it can be proven they were bequeathed in preparation of death. Kentucky offers a 5% discount on inheritance tax paid within nine months of the death.5

Maryland

Inheritances from an estate worth less than $50,000 are not taxed in Maryland. Immediate family members of the deceased — children, spouses, parents, grandparents, stepchildren, stepparents, or siblings — are exempt from inheritance tax. All others pay a tax rate of 10%.6

Maryland also has an estate tax. This means that if you live in Maryland, you could pay an estate tax to both the federal and state governments, and then an inheritance tax, too. The law says if your inheritance tax exceeds a certain amount, no estate tax is due.7

Nebraska

Both spouses and charities are exempt from paying an inheritance tax in Nebraska. (Religious institutions and foreign corporations organized for charitable purposes, however, do not receive this exemption.) Other immediate family members are exempt from paying tax on inheritances of less than $40,000. The tax rates are 1%, 13%, or 18%, depending on the size of the inheritance. All property, including proceeds of life insurance, is taxable in Nebraska.8

New Jersey

Both charitable organizations and immediate family members of the deceased do not pay tax on inheritance in New Jersey. Siblings and in-laws of the deceased are exempt from paying the tax on inheritances of less than $25,000. The rate can be up to 16%, depending on the relationship of the beneficiary to the deceased.9 What the beneficiary pays will also depend on the state in which he/she lives.10 Anything the deceased person owned, including real estate, stocks, cars, and houses, can be subject to this tax.

Pennsylvania

In Pennsylvania, spouses and children younger than 21 are exempt from paying inheritance tax. Other direct descendants pay a 4.5% tax; siblings pay 12%; and other heirs excluding charities, pay 15%. Some farmland and agricultural property is also exempt from the tax. The state government gives a 5% discount on this tax if it’s paid within three months of the death.11

Is There a Workaround?

The most common way people protect their beneficiaries from paying an inheritance tax is to give away their assets before they die. In many states, gifts of a certain size made more than three years before death aren’t taxed. Life insurance payable to a beneficiary doesn’t usually get taxed, either. Another way people preemptively avoid this tax is by putting their assets into a trust, which gets taxed differently than an inheritance.9

Capital Gains Tax

Another thing it pays to understand and bear in mind is that you may have to pay capital gains tax on an inheritance that creates taxable income. For example, if you inherit a stock portfolio that continues to register gains after the date of its investor’s death, you might be responsible for paying tax on those gains.7

Do Your Homework

Inheritance tax, like any other tax, can get complicated. If you live in one of the five states that collect it, you might want to seek legal advice as you put together your will so that your beneficiaries won’t be hit with a large tax bill after your death. You can start the research process by browsing our database of free legal forms to better understand what you can include in your will.

Sources

- https://www.academia.edu/40604055/Augustus_the_Inheritance_Tax_and_Elite_Networks

- https://www.aarp.org/money/taxes/info-2020/states-with-estate-inheritance-taxes.html

- https://revenue.ky.gov/Individual/Inheritance-Estate-Tax/Pages/default.aspx

- https://marylandtaxes.gov/individual/estate-inheritance/estate-inheritance-tax.php

- https://www.nerdwallet.com/article/taxes/inheritance-tax

- https://nebraskalegislature.gov/laws/statutes.php?statute=77-2001

- https://smartasset.com/taxes/all-about-the-inheritance-tax

- https://www.state.nj.us/treasury/taxation/inheritance-estate/inheritance.shtml

- https://www.revenue.pa.gov/TaxTypes/InheritanceTax/Pages/default.aspx