Deeds transfer property from one party to another. The overwhelming majority of real estate transactions use just three types of deeds to transfer title, and there are differences that could affect your ownership status down the line, especially if you elect to use the wrong type of deed.

The main differences are the level of warranties provided — or if any are provided at all. Warranties are special guarantees that would make the seller liable should there be certain title defects, which could amount to problems with the new owner’s right to hold interest in the property.

Contents:

- What is a Deed?

- The 3 Types of Deeds

- Key Differences Between Property Deeds

- What Do I Need to Properly Execute a Deed?

- How to Add or Remove a Name to a Deed

- Video

What is a Deed?

Deeds are legal documents that transfer title between one person and another. While title means that you own something and have the right to use it, it’s a concept and not an actual document. The deed is the paper-and-ink form that legally carries over ownership. In essence, deeds can be thought of as a special legal vehicle driving ownership (interest) from a grantor to a grantee.

When signed and properly executed, deeds are legally defensible. But deeds must fulfill some general requirements:

- A deed must make a declaration that it is a deed, perhaps by saying “this deed…”;

- it must describe the property in question; and

- there must be operative words or words showing intent on the part of the grantor to convey title to the grantee.

The 3 Different Types of Deeds

There are three main types of deeds involving property:

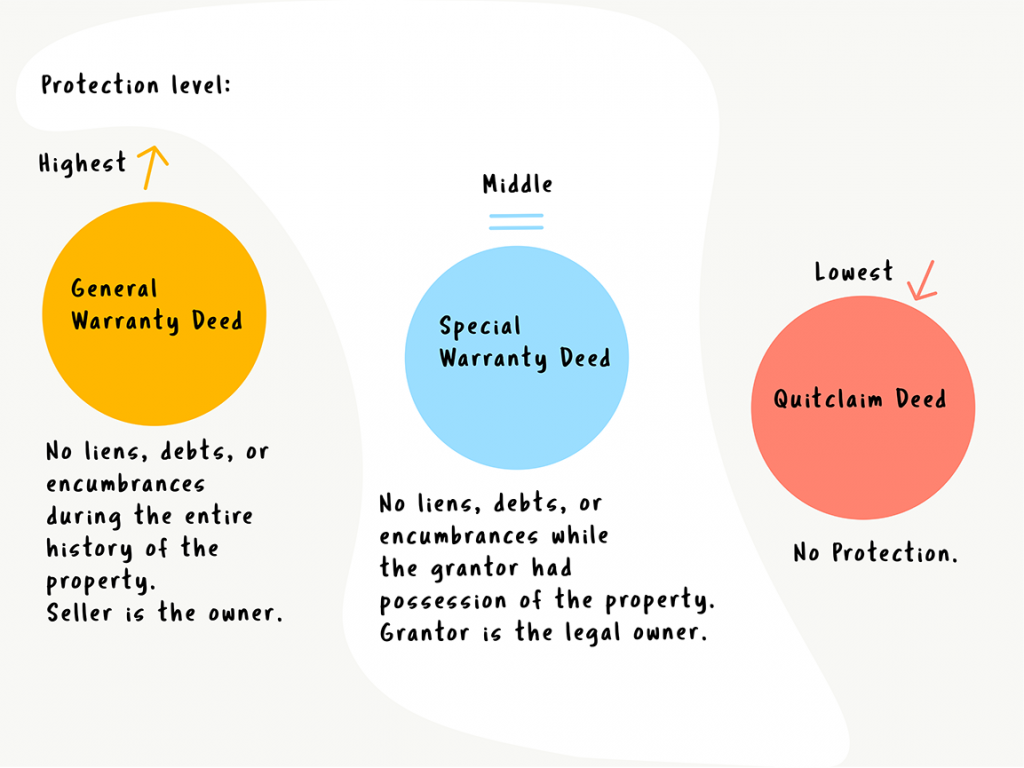

General Warranty Deed

General warranty deeds are the most common deeds used and afford the most guarantees and protection for buyers. The seller offers a binding promise, called a warranty, that the seller holds clear title to a piece of property and has the authority to sell it. It also — and this is, perhaps, the most important distinction — provides title guarantees not only for the period of time that the current title holder owned the property, but also for the entire period of time stretching back to the property’s originations.

General warranty deeds are common in your typical real estate transaction, especially when buyers obtain financing. In some cases, it’s possible to create a general warranty deed without the help of a lawyer.

Special Warranty Deed

A special warranty deed provides less coverage than a general warranty deed but guarantees a clean title for the period of time that the current grantor owned the property.

In situations with a special warranty deed, a seller or grantor may not be familiar with the history of the property before they took ownership, so they can’t guarantee that there were any title defects before they took possession. They do, however, guarantee that during the time they owned the property, all was ship-shape.

Quitclaim Deed

A quitclaim deed’s sole purpose is to painlessly transfer a grantor’s interest in property to another person — without any protections. A quitclaim doesn’t include any warranties or guarantees, and the grantor is not liable for any defects. A quitclaim does not even guarantee that the party transferring interest is the real owner of the property.

Quitclaims are most often used to transfer property between family members. In the case of divorce, ex-spouses may use a quitclaim to remove one party’s name and interest from the title.

Key Differences Between Deeds

What Do I Need to Properly Execute a Deed?

“Executing” a deed means to sign with all preconditions in place. Signing requirements for deeds vary by state, but generally, real estate deeds require the following to be legally defensible:

- Signature of the grantor

- Witness signature(s)

- Acknowledgement by a notary public

For your state’s deed signing requirements and recording locations, visit here.

How to Add or Remove a Name to a Deed

When there are modifications to who holds title, the deed must be changed. And whether you’re selling a home to a new owner or wish to add your spouse to the deed, the process is similar.

If you bear sole title to a property and want to add your partner to the deed, you, the grantor, would write out a new deed transferring title from yourself to yourself and the new owner.

When it comes to removing a name, this can’t be done passively — meaning both parties must agree on a change of ownership, or there must be a court order. When two legitimate owners agree to transfer title to one party, it’s common to use a quitclaim, which will release one party’s interest.