Are you preparing to buy a home? Unless you have huge sums of money lying around uncommitted, it’s likely that you’ll be taking out a mortgage, a loan that lets you live in the home while it’s being repaid.1 (Mortgages can also be sought by businesses, and for other purposes like purchasing equipment, but those are not the focus of this article.) Within this broad outline are many different kinds of mortgages, with costs and benefits that will depend on your situation.

So, which one is right for you? Let’s take a look at the types of mortgages and the pros and cons of each.

Get this: Considering average home prices and interest rates, a typical borrower will pay $106,520 in interest during a 30-year fixed mortgage at 3% interest.2

Table of Contents

- Mortgage Basics

- 30-Year Fixed-Rate

- 15-Year Fixed-Rate

- Adjustable-Rate Mortgage

- Government-Backed Mortgages

- Jumbo Mortgage

- Interest-Only Mortgage

- What’s APR?

- Video

- Sources

Mortgage Basics

Although there are different kinds of mortgages, there are a few terms and ideas that recur in all of them. A mortgage is a financial instrument that can help someone — we’ll call them the “borrower” or the “mortgagor” — acquire a home that they can’t immediately afford by borrowing the amount needed from someone else, who is usually known as the “lender” or the “mortgagee.” The lender and the borrower agree to a payment plan that spreads the cost out over time, making it easier for the borrower to afford the home. In almost all instances, the lender will be a bank or financial institution.

What’s in it for the lender? First, the repayment agreement contains some kind of interest, which means the mortgagor ends up paying back more than originally borrowed, sometimes a lot more. And second, if for some reason the borrower can’t follow the payment plan, the lender has the right to take the home, which is known as “foreclosure.” Below are some other key mortgage terms.

Principal

The amount that the hopeful homeowner needed to borrow originally. When the principal is paid back, the mortgage is “amortized,” meaning the loan is paid off, and the borrower owns the home free and clear.

Down payment

Some amount of money that’s required before money is lent. As will be discussed in further detail below, the amount will vary depending on the type of mortgage, and some kinds of mortgages do not require a downpayment at all. Down payments are usually expressed as a percentage. For example, if you want to buy a home for $500,000 and the mortgage agreement calls for a 20 percent down payment, you’ll have to come up with $100,000. In most cases, if a borrower opts for a down payment of less than 20 percent, she’ll need to obtain private mortgage insurance, a policy that protects against failure to make mortgage payments, which the borrower pays for but which benefits the lender.3 Just a note in case you feel like adding it: In most cases the mortgage insurance is no longer required when 20% of the value of the house has been paid.

Another thing to consider about down payments: Although it may be difficult to come up with the money right off the bat, a higher down payment will almost always save you money down the line, because there’s a smaller principal amount on which you’ll owe interest.

Interest

Interest can be thought of as the cost of borrowing money. An interest rate is a rate associated with a particular loan, again expressed as a percent. (However, calculating interest is a bit more complicated than a downpayment, as will be seen below.) The rate will depend on several things, including the condition of the financial markets and the borrower’s financial history. The term “interest” may also be used to refer to a dollar amount of a mortgage payment that is going toward accumulated interest, rather than principal.

So, which type of mortgage is right for you?

The 30-Year Fixed-Rate Mortgage

This is by far the most common type of mortgage in the United States, accounting for as many as 90 percent of the mortgages created in a given year.4 Like the name implies, a 30-year fixed-rate mortgage allows the buyer to repay the seller in monthly payments over a period of 30 years, and the interest rate is fixed at the time of the mortgage, which means that the payment the borrower makes each month is also the same.

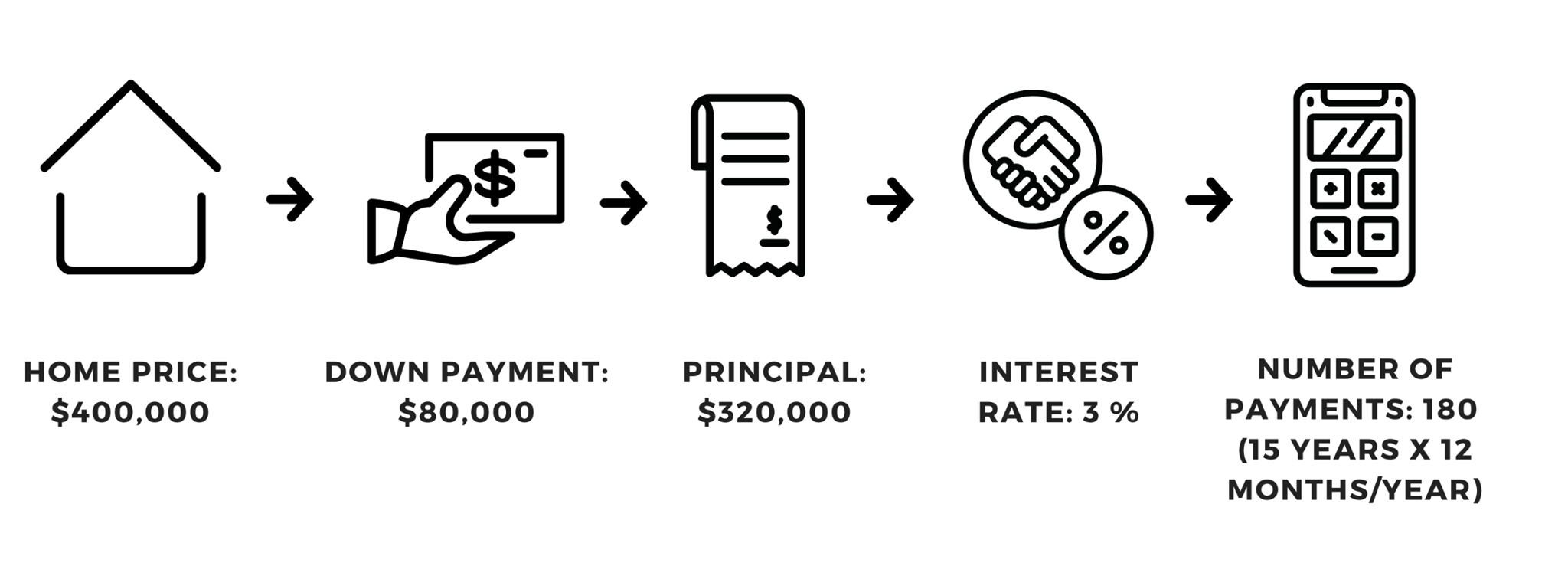

Here’s a basic example. Let’s say you want to buy a home that costs $400,000.

Down payment: At 20 percent, your down payment would be $80,000. That means the principal, the amount actually borrowed and which needs to be paid back, is $320,000. Because the down payment is at least 20 percent, mortgage insurance won’t be figured into this example.

Interest rate: Again, the rate will vary over time and from buyer to buyer. But for this example, let’s say the interest rate is 3%.

- Once you know the principal and the interest rate, you can figure out your monthly payment. For a principal of $320,000 at 3 percent interest, a 30-year fixed-rate loan would have a monthly payment of $1,349.07.

- You can do this by hand if you know the principal, the interest rate and the number of payments. (In a 30-year loan, that would be 360 payments.) But the math is a bit complicated, so there are mortgage calculators all over the internet to do it for you, like this one.

- Once you know the monthly payment, you can figure out how much you’ll be paying on the loan. Multiply the monthly payment by the number of times you’ll be making it, which is 360, or 30 years at 12 months per year. This works out to $485,688.

- If we subtract $320,000 from that number, we can see that the total cost of the mortgage is $165,688 more than the amount you originally borrowed. This is the total interest on the loan, and it’s an important figure to keep in mind as you try to settle on which type of mortgage is right for you.

Amortization

With a fixed-rate mortgage, even though each monthly payment is the same each month, the relative share made up by interest and principal will change over time. The math is easier than figuring out the payment, but there are a lot of amortization calculators on the internet to help you, like this one.

Amortization spreads a loan out into monthly payments and shows you a breakdown of payment data, payment schedules, and your eventual payoff date. Plugging the example above into an amortization calculator shows that, on the very first payment you make toward your mortgage, $800 of it is interest. The remainder — $549, or $1349 – $800 — goes toward the principal. Each month, as the principal gets paid down, interest will represent a smaller and smaller share. This is especially important to keep in mind for those who were required to purchase mortgage insurance. Mortgage insurance is automatically canceled when you owe less than 78 percent of the home’s original purchase price, but you can have it canceled as soon as you owe less than 80 percent.5

Pro Tip: If you were required to get mortgage insurance, keep an eye on your principal, and contact your lender about canceling the policy once you have paid down 20 percent of the purchase price.

Benefits: The main benefit of a 30-year fixed-rate mortgage is that it allows you to spread the costs out over a long time, making it easier to afford a home you might otherwise struggle to afford.

Downsides: By spreading out the payments over a long time, you end up paying a lot of money in interest. If you have more resources, it might be worth considering a mortgage with a shorter term.

The 15-Year Fixed-Rate

Like the 30-year fixed-rate, the interest rate doesn’t change, but you are expected to pay it off in half the time. Let’s return to the example above to see what this looks like.

- Home price: $400,000

- Down payment: $80,000

- Principal: $320,000

- Interest rate: 3 percent

- Number of payments: 180 (15 years x 12 months/year)

With these factors, your monthly mortgage payment would be $2,210, almost $900 more than it would in the 30-year fixed-rate. But what about the total cost of the life of the loan? Multiplied by 180 payments and you get $397,800. That’s $77,800 more than the principal, while with the 30-year loan, you would end up paying more than $165,000 extra.

Benefits: A 15-year fixed-rate loan can save you money over the course of your mortgage, potentially a lot of money. It’s also a faster path to build equity, which is defined as the difference between the home’s market value and the amount you owe on the mortgage principal. This would allow you to take out a home equity loan, which generally has low-interest rates, and can be tax-deductible if you use the loan to improve your home.6

Downsides: The higher monthly payment will be a greater strain on your monthly finances. Also, it’s possible that the market in the area you’re buying could turn for the worse, making it harder to build equity in that time span.

Adjustable-Rate Mortgage

While both of the previous examples featured interest rates that don’t change, they can and will with an adjustable-rate mortgage. Often, an adjustable-rate mortgage will start out with a lower interest rate than could be found with a fixed-rate option, but will change after a defined period of time, and can be changed again periodically over the course of the life of the loan, which can be for 30 years, or lesser amounts. A common variety of adjustable-rate mortgage is known as the “5/1,” which means that the initial interest rate is fixed for five years, and then can be adjusted once per year.7 Sometimes the initial rate is called a “teaser.”

The interest rate for an adjustable-rate mortgage has two parts: the “index” and the “margin.” The index is a measurement of the cost of lending money, which changes over time, and is usually determined by reference to certain widely used financial measurements, such as the Constant Maturity Treasury (CMT) rate.8 The margin is an extra amount that the lender adds to the index. Both the index measurement and the margin can vary from lender to lender, so be sure to inquire.8 As with a fixed-rate mortgage, you’ll get a disclosure form before closing on an adjustable-rate mortgage, which will disclose the minimum and maximum possible interest rates you could face.

Here’s an example of a disclosure form for an adjustable-rate mortgage. Note that once the initial rate period expires, the monthly payments become variable. Because of this, comparing the total amount you would pay to the principal, as was done for the 30- and 15-year fixed-rate loans, isn’t possible.

Benefits: Adjustable-rate mortgages can save you money. For example, if you only live in the home for a few years before selling it, you could take advantage of the lower initial interest rate and still reap the same increase in property value that a fixed-rate mortgage holder would. Before considering this, you should examine your loan to see whether the terms of your mortgage include “prepayment penalties,” which could offset money you’d earned during the life of the mortgage.9

Downsides: Life can be unpredictable: jobs can end, property values can go down, and interest rates can do unexpected things. Because of the risk inherent in adjustable rates, you could find yourself facing a far higher payment than expected, and if you are unable to make it or refinance, you could lose your home.

Government-Backed Mortgages

The previous types of mortgages are often called “conventional” mortgages. There are several types of mortgages that are issued by private lenders, but backed by the government.

FHA loans

FHA mortgages are insured and regulated by the Federal Housing Administration

Benefits: FHA loans allow for down payments as low as 3.5 percent, and are available to people with poor credit history.10

Downsides: All FHA loans require FHA mortgage insurance. Like the private mortgage insurance discussed above, FHA loans can add to the cost, and in some cases it may be more than private mortgage insurance.11 If you have good credit or can make a more substantial downpayment, a conventional mortgage may be a better idea. There’s also a limit on how big your mortgage can be, depending on where you live. To see how much money you can borrow for an FHA loan, go here.

VA loans

VA, or Veterans Administration, loans are for people who are either military veterans or current service members.12 VA Loans require no down payment at all, and also may be easier to obtain than a conventional mortgage for people with poor credit histories.

Benefits: No mortgage insurance requirement all. Refinancing may also be easier to obtain than with conventional mortgages.13

Downsides: Most borrowers must pay a one-time free of up to 3.6 percent of the value of the loan. (This fee is not required for people with disabilities acquired as a result of military service.)14 FHA loans also generally require that a home be occupied within 60 days of closing on the mortgage, and can’t be used if that home being purchased is in poor condition.14

USDA Loan

USDA, or U.S. Department of Agriculture, Loans are targeted at people hoping to own homes in rural areas. The programs are specifically targeted at people in need of affordable housing, and the benefits-and-downsides comparison done for other types of loans don’t apply here. The bigger question is eligibility. There are two types, each with many restrictions.

Single-family home loan guarantee: Intended for low- and moderate-income households, and to be used as a primary residence. The property size must be comparable to those in the area.15 To see whether your income and the home’s location meet requirements, go here.

Single-family direct: Intended for low- and very-low income households, specifically those currently lacking decent housing.16 Along with low interest rates, the government can also provide payment assistance at the beginning of the loan.16 The property size must be “modest” in comparison to those in the area. To see whether your income and the home’s location meet requirements, go here.

Jumbo Mortgage

To encourage private lenders to extend mortgages to more people, the federal government buys many of the mortgages issued by banks around the country. But it sets a limit on the size of the loan it will acquire. For 2020, that limit is $510,400 for most of the country, and up to $765,400 in high-cost areas.17 Because lenders must carry loans larger than this on their books, so-called jumbo mortgages tend to come with additional costs or obstacles for borrowers, including inflexible down payment requirements and higher desired credit scores.18

Benefits: A jumbo mortgage may be the only way to purchase expensive homes. And while they traditionally carried higher interest rates than conventional mortgages, in recent years the rates have become comparable or even cheaper.19

Downsides: The difficulty in obtaining jumbo mortgages will likely make it more time-consuming to sell a home requiring one.20

Interest-Only Mortgage

Interest-only mortgage payments require the borrower to only make interest payments, rather than interest and principal, for several years. Usually, the period is between three and 10 years.21 Interest-only mortgages have become less common since the Great Recession, when they were associated with the subprime lending crisis.22

Benefits: For those who expect their income to rise after the interest-only period ends, or want to use that time to devote money to other purposes, an interest-only mortgage can work. To return to the example that we used with a 30-year fixed-rate mortgage, for the first 10 years, your payment would be only $800 per month, instead of $1,349 per month.

Downsides: Once the interest-only period expires, you’ll have to pay both interest and the entirety of the principal in a shorter time period. This means that your monthly payment will be higher than it would have been with a conventional, fixed-rate mortgage, and you will also likely pay more in total interest. In the example above, after the 10-year interest-only term expires, your payment would jump to $1,774.71 per month. And the total amount of interest you’d end up paying would be $201,931, more than $30,000 higher than the total interest on a 30-year fixed-rate mortgage.

Here’s a calculator that lets you see what your payments would be with an interest-only mortgage. Further complicating matters, many interest-only mortgages have adjustable rates, not fixed ones, once the initial period expires.23

What’s APR?

In all of the discussions above, the costs we’ve been concerned with are primarily interest and principal payments, and mortgage insurance. But as you look for a mortgage, you’re probably going to see another term: APR. APR stands for “annual percentage rate.” You will probably see it mentioned in advertisements for different kinds of mortgages. Essentially, APR includes the interest rate and other costs or fees associated with obtaining a mortgage.24 These can include:

Origination fees

A fee charged by a lender for the work of setting up a mortgage. Laws enacted since the Great Recession limit how high origination fees can reach, and now most are set at one percent or less.25 You may also hear the term “closing costs,” or this may be wrapped into the origination fee.

Discount points

Like a down payment, discount points involve paying some money up front in exchange for reducing the amount owed in the long run. Discount points, however, affect the interest rate, rather than the principal. Usually, one “point” costs one percent of the amount of the loan, and will move the mortgage rate down by one-fourth to one-eighth of a percent.26 Whether discount points are a good idea to pursue depends on factors that will be unique to your situation, but in general, they become more worthwhile the longer you plan to hold on to the home you’re purchasing because you’ll have more monthly payments to cover the cost of the points.27

Other Fees

There are other additional fees that are typically not included with APR, such as title search, to ensure that the person selling the home has a good title to pass on, escrow fees, for a third party that will hold on to the money while the transaction processes, and property taxes. You also will usually have to pay for homeowner’s insurance, because a mortgage gives the bank the ability to take back the home if you don’t make the payments, and the bank will want to make sure that the home is in good condition.

Federal law requires that the borrower receive a Closing Disclosure, previously known as a Truth in Lending Disclosure, at least three days before agreeing to the mortgage loan. This form will contain the costs that go into the loan you are getting from the bank.28 Here’s an example of what one might look like.

One final note on APR: Choosing the lowest APR is not necessarily the best deal for every mortgage. Sometimes a lender will advertise a lower APR but the loan will feature a higher interest rate; in this example, if the buyer and the seller agree on their own that the seller will pay closing costs, it might be better to seek out a mortgage with a higher APR, but lower interest rate.29

Video

Sources

- https://scholarlycommons.law.case.edu/cgi/viewcontent.cgi?article=1518&context=caselrev

- https://www.thebalance.com/average-monthly-mortgage-payment-4154282

- https://themortgagereports.com/24154/private-mortgage-insurance-pmi-cost-low-downpayment-return-on-investment

- https://www.mortgagecalculator.org/mortgage-rates/30-year.php

- https://www.bankrate.com/mortgages/removing-private-mortgage-insurance/

- https://www.investopedia.com/personal-finance/home-equity-loans-what-to-know/

- https://www.rocketmortgage.com/learn/5-1-arm-loan

- https://files.consumerfinance.gov/f/documents/cfpb_charm_booklet.pdf

- https://www.debt.org/real-estate/mortgages/adjustable-rate/

- https://www.consumerfinance.gov/owning-a-home/loan-options/fha-loans/

- https://www.bankrate.com/mortgage/fha-mortgage-insurance-guide/

- https://www.usaa.com/inet/wc/advice-real-estate-is-va-loan-way-to-go?akredirect=true

- https://www.va.gov/housing-assistance/home-loans/loan-types/interest-rate-reduction-loan/

- https://www.usaa.com/inet/wc/advice-real-estate-is-va-loan-way-to-go?akredirect=true

- https://www.rd.usda.gov/sites/default/files/fact-sheet/508_RD_FS_RHS_SFHGLP.pdf

- https://www.rd.usda.gov/sites/default/files/fact-sheet/508_RD_FS_RHS_SFH502Direct.pdf

- https://www.fhfa.gov/news/news-release/fhfa-announces-maximum-conforming-loan-limits-for-2020.

- https://www.experian.com/blogs/ask-experian/what-is-a-jumbo-loan/#:~:text=A%20jumbo%20loan%2C%20or%20jumbo,home%20mortgages%20in%20the%20U.S.

- https://www.corelogic.com/intelligence/why-are-jumbo-loans-cheaper-than-conforming-loans

- https://www.experian.com/blogs/ask-experian/what-is-a-jumbo-loan/#:~:text=A%20jumbo%20loan%2C%20or%20jumbo,home%20mortgages%20in%20the%20U.S.

- https://www.debt.org/real-estate/mortgages/interest-only/

- https://www.cnbc.com/2020/07/06/interest-only-mortgages-might-make-sense-in-some-situations.html

- https://www.investopedia.com/articles/managing-wealth/042516/how-interestonly-mortgages-work.asp

- https://www.consumerfinance.gov/ask-cfpb/what-is-the-difference-between-a-mortgage-interest-rate-and-an-apr-en-135/

- https://www.investopedia.com/terms/o/origination-fee.asp

- https://themortgagereports.com/13644/discount-points-for-mortgages-explained-in-plain-english

- https://bettermoneyhabits.bankofamerica.com/en/home-ownership/buying-mortgage-points-lower-rate

- https://www.consumerfinance.gov/ask-cfpb/what-is-a-closing-disclosure-en-1983/

- https://www.zillow.com/mortgage-learning/what-is-apr/#:~:text=If%20you%20pay%20your%20property,to%20you%20by%20the%20lender