When it comes to paying off debt, a common method is to simply acquire a larger personal loan that either consolidates payments or lowers interest rates and the overall cost. But that seems like an odd way to go about things, doesn’t it? Does borrowing more actually help you relieve existing debt?

As is the case with many things in life, the answer could be ‘yes’ just as easily as it could be ‘no.’ Every individual and their specific financial situation can create new factors in the ability to pay off existing credit card debts, restructuring car loans, mortgages, and any other common forms of debt we work so hard to erase. So one solution for your now-debt-free best friend may not be the best route for you to find financial freedom.

So rather than simply asking, ‘Should I get a loan to pay off my debt?’ consider finding more direct, tangible answers to the following questions in order to decide if a new personal loan will help you live debt free:

Contents

- Most Common Types of Debt

- Will a Personal Loan Lower My Interest Rate?

- Can Family or Friends Help Me Pay Off My Debt?

- Will a Personal Loan Lower My Monthly Payments?

- Should I Consolidate My Monthly Payments?

- Video

- Sources

Most Common Types of Debt

The four most common types of debt in America come from credit cards, student loans, mortgages, and auto loans.

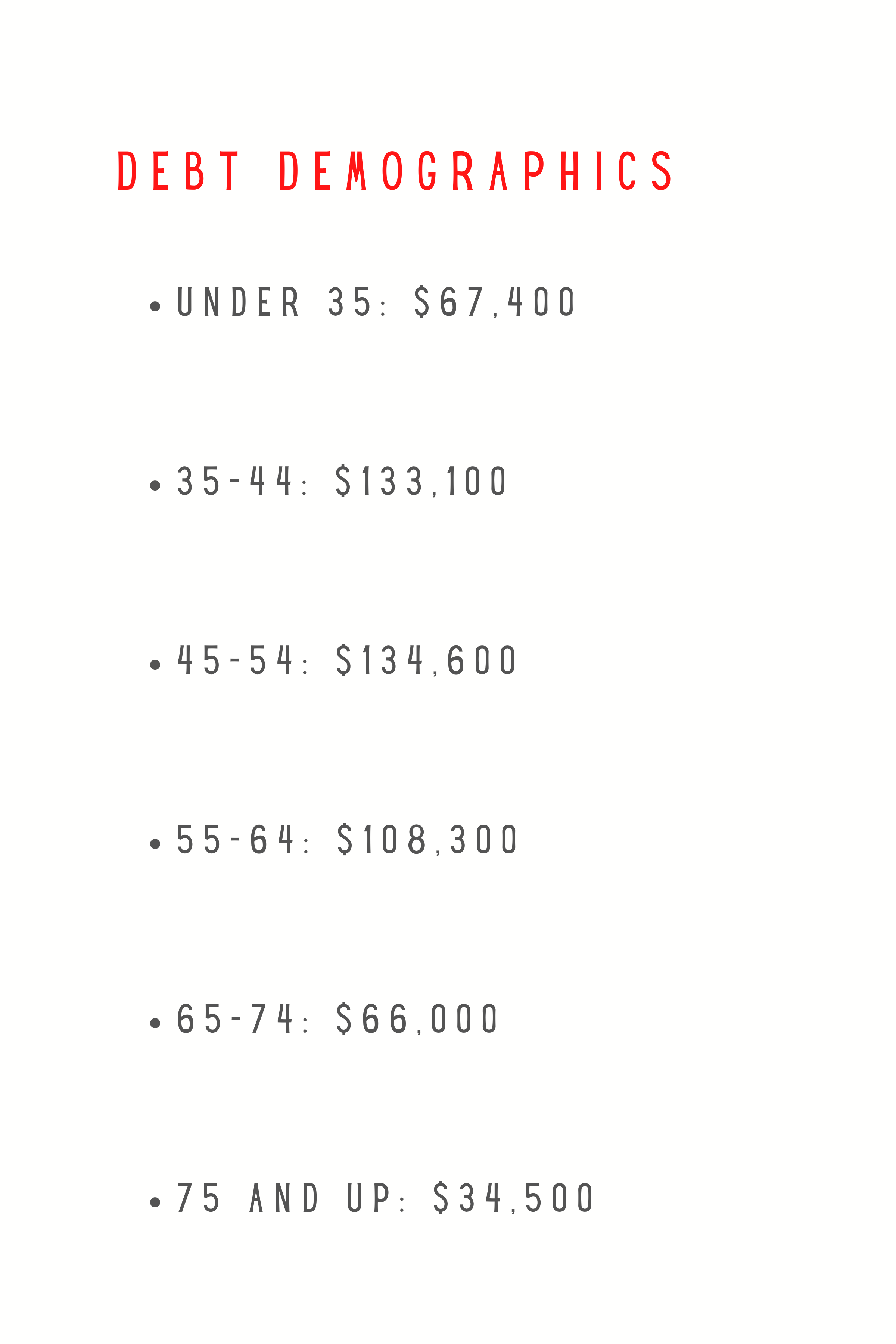

Unsurprisingly, how much debt and which of these four categories you may find yourself in is heavily dependent on age demographics, according to debt.org, who says the average total debt of individual Americans ranges from nearly $70,000 up to over $134,000.1

The under 35 demographic is most often living with a combination of credit card debt, auto loans, and student loans. Each has their own common interest rates, terms, loan life, and available options when times get tough and you need some wiggle room for making payments. Whether it’s deferment of payments or renegotiating your rates, there are always other options you can examine with a lender before turning to a new personal loan altogether.

Will a Personal Loan Lower My Interest Rate?

Lowering interest rates is typically the first thing people hope to accomplish by using one new loan to pay off existing debt.

With a lower interest debt consolidation loan, you can most often extend the window of time used to pay off the full balance and therefore create more room in your monthly budget in order to make payments on time, or you can apply those savings from the lower interest toward the principal balance and clear that debt sooner. Either way, be diligent and research the proverbial fine print, as there can be a sneaky list of cons for every apparent pro in that alluring low-interest offer. Just a few include, for example:

- Most personal loans will come with a fixed monthly payment. Therefore, if you’re already struggling to make set, standard payments with existing credit card debt, you may be setting yourself up for more debt you can’t manage.

- If early payoff is important to you, be sure the loan you seek allows this. Some lenders enforce early payoff penalties in the fine print.

- Origination fees, or upfront fees, can tack some money onto that price tag just to get you started. Again, this is a situation where you’ll have to crunch the numbers and ensure you’re actually saving money in the long run.

Can Family or Friends Help Me Pay Off My Debt?

There are certainly times where a family member or family friend may have the means to help us clear our debt to creditors. In this scenario, the terms of repayment — whether this option buys you some time to pay off a balance or the goodwill of a family member turns into wiping away the interest you’d otherwise owe — can likely be more flexible.

Now, when it comes to lending and borrowing in your personal circle, things can be risky for entirely different reasons than the dangers of borrowing from a bank. Relationships can be strained without clear terms and agreed-upon expectations, creating an entirely new set of stressors in your life. For this reason, it’s always a good idea to create a formal agreement that will outline everything from the interest to payment due dates and any possible penalties, as a matter of creating accountability.

Will a Personal Loan Lower My Monthly Payments?

Most of us live with a monthly budget. We have an expected income and adjust our spending accordingly within each 30-day window, and somewhere in that to-do list of bills are likely monthly payments toward debt.

Taking all of your monthly minimum credit card payments and adding them up, you can get an idea of how much you are paying every 30 days toward principal and how much you are paying toward interest. In many cases, one large personal loan to pay all of those credit cards off will simply apply all your payments toward a single balance with your debt in one place rather than several. So for example, if you were paying $750 per month in minimum payments to the credit card companies but a new personal loan drops that minimum payment to $600, you now have $150 more in your monthly budget.

Should I Consolidate My Monthly Payments?

According to Forbes Advisor, about 84% of adults have credit cards. Interestingly, a significant number of people – approximately 73% – own one by the time they turn 25.2 It just goes to show how prevalent credit card usage is in today’s society. That means a lot of people have multiple credit cards, each with their own payment due dates, balances, and interest rates. How well (or poorly) you manage these separate payments can heavily influence the benefit of consolidating it all into a single monthly payment.

For many who are trying to eradicate credit card debt altogether, this is a matter of simplification and efficient management. But if you’re simply funneling debt from multiple sources into just one, only to turn around and use those now-open balances for more spending, then you’re only creating more debt in the long run.