As of October 1, 2021, there have been over forty-three million (43,000,000) cases of COVID-19 in the United States and almost seven-hundred thousand (700,000) deaths. Current hospitalizations due to COVID sit at over seventy-thousand (70,000) while nearly one-hundred eighty-five million (185,000,000) American citizens and residents have been fully vaccinated against the virus.1

The effect this situation has had on small businesses in the U.S. is well-known. They have lost revenue and staff, and many have shuttered entirely as a result of COVID-19 shutdowns. Now, eighteen months into the pandemic, many financial relief opportunities for small businesses have expired or will expire soon. We’ve compiled a list of ongoing options for businesses to take advantage of.

Table of Contents

- Economic Injury Disaster Loan (EIDL)

- Paycheck Protection Program (PPP)

- Small Business Association Debt Relief

- U.S. Department of Treasury Employee Retention Credit

- Other Funding Opportunities

- State-Specific Resources for Small Businesses

Economic Injury Disaster Loan (EIDL)

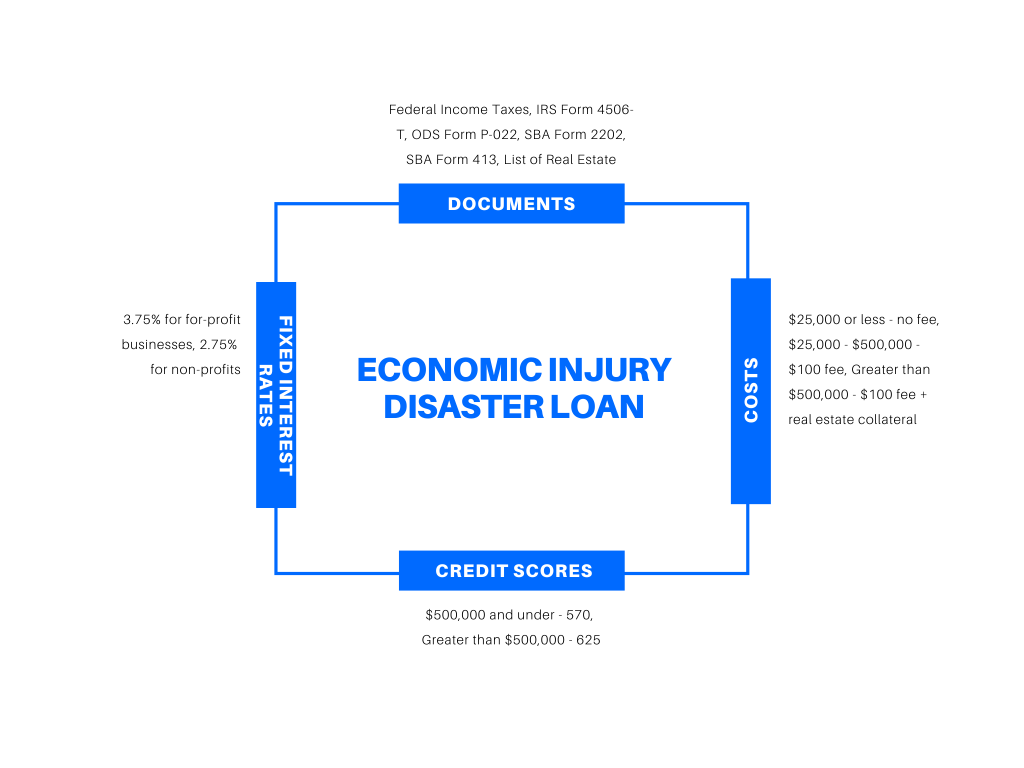

The Small Business Association’s Economic Injury Disaster Loan (EIDL) provides capital to help small businesses cover necessary operating expenses. Qualified expenses include but are not limited to business debt, payroll, mortgage payments, rent payments, and utilities. It is a low-interest, fixed-rate loan with a thirty (30) year term. The fixed-rate is 3.75% for for-profit businesses and 2.75% for non-profits.2

The EIDL is not eligible for forgiveness. However, payments are deferred for the first two (2) years of the loan term. Interest will accrue in those first years, but there are no penalties for prepayment. (source 2)

The maximum loan amount is $2 million. Businesses can apply online through the SBA’s application portal. Existing loan holders can apply for an increase to their loan here. All loans greater than $25,000 require collateral, and all loans greater than $250,000 also require a personal guarantee. The following documents are required to submit with an application:

- Federal income taxes;

- IRS Form 4506-T;

- ODA Form P-022-Standard Resolution;

- And for loans greater than $500,000

- SBA Form 2202 – Schedule of Liabilities;

- SBA Form 413 – Personal Financial Statement; and

- List of owned real estate2

Applications for this loan follow this fee structure:

- $25,000 or less – no fee

- $25,000 – $500,000 – $100 fee

- Greater than $500,000 – $100 fee + real estate collateral2

The EIDL also has the following credit score requirements:

- $500,000 and under – 570

- Greater than $500,000 – 6252

Paycheck Protection Program

The Paycheck Protection Program (PPP) is a loan program established by the CARES Act. The program closed on May 31, 2021. Any business that currently has a PPP loan may be eligible for loan forgiveness.3 Both “First Draw” and “Second Draw” loan holding businesses are eligible for total forgiveness if they:

- Used all of the loan funds for payroll and other qualified expenses;

- Put a minimum of 60% of the loan funds directly into payroll; and

- Maintained employees’ wage levels.4

Small business loan holders can apply for forgiveness as soon as they have used up all of the funds from the loan. They have until the loan’s final due date to apply. There are two ways to apply, depending on the lender. If a lender is on this list, the loan holder can apply for forgiveness directly through the Small Business Administration PPP Direct Forgiveness Portal. These businesses can use PPP 3508S Loan Forgiveness Application & Instructions to apply in person or by mail.4

If a lender is not on the list mentioned above, the loan holder will have to apply for forgiveness directly through the lender. If the lender doesn’t have their own application form, a loan holder can use one of the following4:

- PPP 3508 Loan Forgiveness Application + Instructions

- PPP 3508S Loan Forgiveness Application & Instructions

- PPP 3508EZ Loan Forgiveness Application + Instructions

It is often required to include the following documentation with any of the previously mentioned applications:

- Employer contributions to employee health insurance and retirement plans;

- Mortgage interest or rent payments;

- Operations expenses;

- Payroll reports;

- Payroll tax filings;

- Property damage expenses;

- Supplier costs;

- Unemployment insurance tax filings;

- Utility payments;

- Wage reports; and

- Worker protection expenses.4

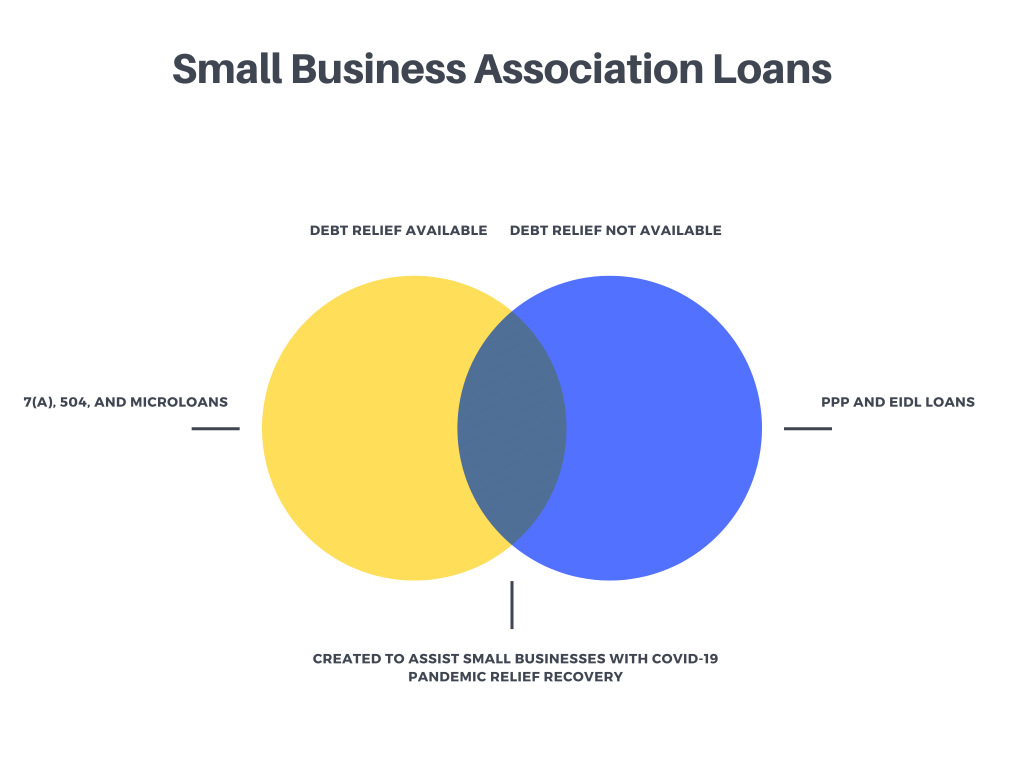

Small Business Association Debt Relief

For small businesses that hold existing SBA loans approved on or before September 27, 2020, the SBA will cover six (6) months of principal, interest, and fees. This coverage applies to all 7(a), 504, and Microloans but doesn’t apply to PPP or EIDL loans. The SBA will process these payments automatically, so there is no need for businesses to apply for debt relief.5

U.S. Department of Treasury Employee Retention Credit

The American Rescue Plan extended the Employee Retention Credit through December 2021. The tax credit allows these businesses to offset their payroll tax liabilities by up to $7,000 per employee per quarter.6 It is only available to companies that meet the following criteria:

- The business experienced a revenue decline of more than 50% in at least one quarter of 2020 compared to the same quarter in 2019; or

- The business had to partially close in response to a government mandate; and

- The business has less than one hundred (100) employees; and

- The business kept its employees on payroll for the extent of the pandemic.7

Other Funding Opportunities

Annuity Freedom Small Business Grants

AnnuityFreedom.net provides two different types of grants for small businesses in response to the pandemic: the BIPOC Small Business Grant and the Minority Business Micro-Grant.

The BIPOC Small Business Grant is a marketing-focused grant that includes free SEO evaluations, advice, and planning services. The grant is directed toward minority-owned businesses. To apply, a small business is required to have:

- a Google account;

- an active website; and

- direct access to the website editor or CMS.

The Minority Micro-Grant has no requirements and provides $100 grants to one small business per month.

Coronavirus Food Assistance Program (CFAP)

The Coronavirus Food Assistance Program (CFAP) is specifically designed for agricultural producers that deal with COVID-19 related market disruptions. This program is available to businesses that produce eligible commodities. Companies can apply online or manually with form AD 3117.

Creciendo Con TikTok

TikTok teamed up with the Hispanic Heritage Foundation to create Creciendo Con TikTok. This program provides $5,000 cash rewards to individual business owners that meet the following criteria:

- Active in the operation of their business;

- At least eighteen (18) years old;

- The business began operating before September 15, 2020;

- Business is in good standing with the IRS and any relevant regulatory bodies; and

- Latinx that owns at least fifty-one percent (51%) of their business.

Fiserv Back2BusinessGrant

Fiserv is a global financial technology and payments company. They have established the Back2Business Grant that awards $10,000 to eligible Black- and minority-owned small businesses affected negatively by the pandemic. To apply, a business has to:

- Be located in an eligible location;

- Be minority-owned by a person that is eighteen (18) years of age or older;

- Have annual revenue less than $1 million;

- Have been in business since before January 1, 2020; and

- Staff less than eleven (11) employees.

GoFundMe Small Business Relief Fund

GoFundMe partnered up with Bill.com, GoDaddy, Intuit QuickBooks, and Yelp to create the Small Business Relief Initiative. The initiative established the Small Business Relief Fund, which provides $500 matching grants to businesses that raise at least $500 with a GoFundMe fundraiser created in response to the pandemic. Any business is only eligible for a one-time grant. Companies cannot receive multiple grants from this fund.

To qualify, a business must:

- Be independently owned and operated;

- Have no fraud reports against it;

- Have suffered in any way in direct response to a pandemic-related government mandate;

- Not hold any national market dominance in its given field of operations; and

- Plan to use the funds to pay for basic business expenses or care for its employees’ well-being.

IFW Covid-19 Relief Fund

IFundWomen (IFW) is a fundraising platform catered towards women-owned businesses. IFW created the IFW Covid-19 Relief Fund, which gives microgrants to companies that have an active fundraising campaign on their site.

KKR Small Business Builders Grant

As a part of its COVID-19 relief effort, global investment firm KKR created the Small Business Builders Grant. These recovery grants are for $10,000 and also include networking opportunities and technical support from KKR experts. They are available to businesses globally. KKR is particularly looking for companies that provide essential community services, are operated by historically underrepresented groups, or are pivoting their business in some way as a direct result of the pandemic.

For a business to apply, it must:

- Be in good standing with the IRS;

- Demonstrate a qualitative need for support;

- Have between five (5) and fifty (50) employees;

- Have less than $7 million in annual revenue; and

- Present a qualified business plan for moving forward.

The Barstool Fund

The Barstool Fund is an ongoing fundraising effort that donates its proceeds to small businesses in the U.S. The only requirement for a business to apply is for it to be still paying its employees.

State-Specific Resources for Small Businesses

Sources

- https://www.sba.gov/funding-programs/loans/covid-19-relief-options/paycheck-protection-program

- https://www.sba.gov/funding-programs/loans/covid-19-relief-options/paycheck-protection-program/ppp-loan-forgiveness

- https://www.sba.gov/funding-programs/loans/covid-19-relief-options/sba-debt-relief

- https://home.treasury.gov/policy-issues/coronavirus/assistance-for-small-businesses/small-business-tax-credit-programs

- https://home.treasury.gov/system/files/136/ERC-Flyer-4.13.21.pdf

- https://www.pgpf.org/understanding-the-coronavirus-crisis/coronavirus-funding-state-by-state?utm_term=covid-19%20program&utm_campaign=COVID+State+Tool&utm_source=adwords&utm_medium=ppc&hsa_acc=1523796716&hsa_cam=11185911289&hsa_grp=113208885521&hsa_ad=467197551728&hsa_src=g&hsa_tgt=kwd-904240186230&hsa_kw=covid-19%20program&hsa_mt=b&hsa_net=adwords&hsa_ver=3&gclid=CjwKCAjwqeWKBhBFEiwABo_XBvWlJ8GrSJTa3Hl_3zGDUHKsEqqp_ouCtDFX-pOUrJ7VPgCbpXutORoCQiQQAvD_BwE