July 31st marked the end of a nearly yearlong federal public health order preventing landlords from evicting tenants for not paying rent due to financial hardship caused by the COVID-19 pandemic. With some 11.4 million people in the United States currently behind on their rent, the expiration of this protective moratorium is likely to bring on a flood of eviction notices being served across the country.1,2

However, it’s not all that simple. Before scuffling into action, landlords and renters alike should know these four important factors that will help them understand their circumstances better and make informed decisions around eviction.

Table of Contents

1. Eviction Ban Expirations Vary By State and Local Jurisdictions

While the federal eviction ban issued by the Centers for Disease Control and Prevention applied to landlords and renters nationwide by default, some state and local jurisdictions have their own versions of the eviction ban that vary in length and conditions.

California, for example, is banning all residential evictions until Sep. 30—two months after the expiration of the federal moratorium—while Illinois is allowing landlords to file for evictions starting Aug. 1 but barring any physical eviction of tenants until September.3

In Minnesota, renters in the process of applying for rent relief are protected from eviction until June 2022, while in Nevada, similar legislation states that tenants cannot be evicted if their rent relief application is pending or if their landlord refuses to accept the aid.4

Certain counties and cities have also enacted their own eviction moratoriums governing their local jurisdictions, though it’s not as common. Still, it is recommended that you look into your state and local ordinances regarding eviction in order to stay lawful and plan your next moves wisely.

If, however, your state, county or city has not adopted its own eviction moratorium, that means your situation would default to the federal level, which no longer provides protection.

2. Certain Single- and Multi-Family Properties Have an Extended Eviction Moratorium

How the property you own or rent is financed can also determine different terms of the eviction moratorium.

For single-family properties backed by mortgages from Freddie Mac and Fannie Mac, government-sponsored agencies that promote homeownership, the moratorium on single-family real estate-owned evictions is extended until at least Sep. 30. In addition, certain owners of multi-family properties backed by these two government-backed mortgage buyers can extend their loan forbearance, with the condition that they cannot evict tenants during the term of the forbearance.

Landlords who extend their loan forbearance must also inform tenants in writing about the available protections during the new forbearance and repayment periods, including giving tenants at least a 30-day notice to vacate, not charging late fees or penalties for not paying rent, and allowing renters flexibility in repaying back-rent over time.5

If you are a renter who is unsure whether your rental property is financed by a government-back agency, you can use the Fannie Mae Loan Lookup Tool and the Freddie Mac Loan Lookup Tool and search for your address.

3. It’s Not Too Late for Both Landlords and Renters to Apply For Rental Assistance

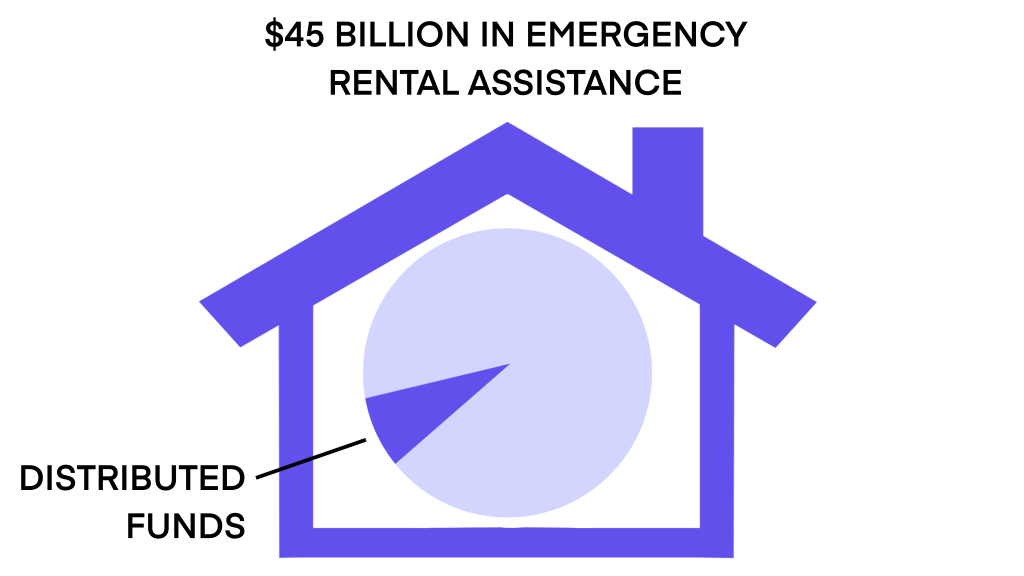

More than $45 billion in emergency rental assistance has been doled out by Congress, but states and local jurisdictions have been struggling to distribute the funds to renters and landlords in need. In fact, as of June, only around $3 billion—less than 7% of the available funds—were issued. That means around $42 billion earmarked for rental assistance are still sitting in the coffers of states, counties, and cities.6

Emergency rental assistance can provide up to 18 months of payments for back and future rent. At least 90% of the funds must be used for direct financial assistance, including rent, utilities, and other expenses related to housing.

Contrary to popular belief, rental assistance is not only for renters. If you are a landlord looking to recover rent owed by your tenants, keep in mind that eligibility is based on your tenant’s needs, such as household income, financial hardships, and their housing situation. If approved, rent payments will likely be delivered straight to you, not the renter.7

Another incentive to seek emergency rental assistance before pursuing eviction is that evicting tenants can be time-consuming and costly with legal fees adding up quickly. Indeed, the American Bar Association has forecasted that, because most evictions have been blocked for so long, there is likely to be an extensive backlog of cases, and that in some jurisdictions it could be as much as a year before a tenant actually faces removal.8 Even after all that, there is still the possibility that you may never recover unpaid rent.

To be eligible for the funding, at least one member of the rental household must qualify for unemployment benefits or provide in writing that they’ve lost income or incurred significant expenses due to the pandemic. Their income level for 2020 must also be below 80% of the area’s median income, though states are likely to prioritize applicants whose income falls below 50% as well as those out of work for more than 90 days.9

If you would like to apply for help, you can find a comprehensive state-by-state list of rental assistance programs at the National Low Income Housing Coalition website.

4. Tenant Protection Laws Still Apply Regardless of Eviction Ban Ending

If you are a landlord who is frustrated by the lack of rent payments from your tenants, you may be eager to pursue eviction as soon as possible now that the moratorium has lifted. However, it’s important to keep in mind that taking matters into your own hands without regard for tenant protection laws and eviction procedures may cost you greatly.

Nearly every state imposes monetary penalties for landlords who pursue “self-help” evictions, such as locking tenants out of their home, shutting off utilities, or making threats. Tenants can also sue their lawbreaking landlords for actual money losses—such as the cost of temporary housing, the value of food spoiled in the fridge, etc.—on top of suing for penalties, such as several months of rent.10

That’s why it’s highly recommended that you brush up on your state’s tenant protection laws in addition to researching which eviction moratoriums apply in your locality. For a quick overview of these procedures, check out eForms rental agreement pages for your state.

Sources

- https://www.cbpp.org/research/poverty-and-inequality/tracking-the-covid-19-recessions-effects-on-food-housing-and

- https://www.nhlp.org/covid/cdc-eviction-moratorium/

- https://www.gov.ca.gov/2021/06/25/governor-newsom-legislative-leaders-announce-eviction-moratorium-extension-increased-compensation-for-rent-relief/

- https://www.nolo.com/evictions-ban

- https://www.fhfa.gov/news/news-release/fhfa-extends-covid-19-multifamily-forbearance-through-march-31-2021

- https://www.marketplace.org/2021/07/23/just-3-billion-in-rent-relief-has-gone-out-with-cdc-eviction-ban-set-to-end/

- https://www.consumerfinance.gov/coronavirus/mortgage-and-housing-assistance/help-for-landlords/

- https://www.americanbar.org/groups/litigation/committees/trial-practice/practice/2021/landlords-tenants-eviction-litigation/

- https://nlihc.org/sites/default/files/National-Eviction-Moratorium_FAQ-for-Renters.pdf

- https://www.nolo.com/legal-encyclopedia/lock-out-tenant-illegal-29799.html