For those looking to borrow or lend money, a promissory note is an essential part of the arrangement that helps to ensure that the parties involved are on the same page. Also known as a “note payable,” it is a legally binding document that outlines the terms and conditions of the loan and holds the borrower accountable for repaying the borrowed amount.

A promissory note functions similarly to an IOU or a loan agreement—with some distinct differences in the clauses included and how it’s commonly used.

Table of Contents

- What is a Promissory Note?

- Types of Promissory Notes

- What to Include in a Promissory Note

- Common Uses of Promissory Notes

- Usury Laws by State

What is a Promissory Note?

A promissory note is simply a promise in writing, stating that the borrower will pay back the full amount of a loan under the lender’s terms of repayment.

It’s often used for home loans, car loans, student loans, personal or business loans, and for more informal arrangements between family or friends. While a loan agreement may provide a detailed breakdown of every aspect of the arrangement, promissory notes are generally simpler in nature with fewer formalities and requirements for what information must be included.

Is a Promissory Note a Contract?

Yes — if the document contains all the legally required terms. Once signed by the borrower, a promissory note becomes a formal contract that is legally binding and enforceable in a court of law.

What Makes a Promissory Note Invalid?

Conversely, a promissory note can be considered invalid if it does not contain all the legally required components, including the borrower’s signature. It can also be voided if the loan interest rate violates the state’s usury laws, which set a maximum cap on the interest rate that lenders are allowed to charge.

Types of Promissory Notes

While all promissory notes share the same objective (which is to hold the borrower liable for the amount of a loan), they can vary in design and repayment methods depending on the type of the note.

Secured vs. Unsecured

A secured promissory note requires the borrower to provide a form of collateral in case of non-payment. This means that if the borrower fails to meet the terms of repayment, the lender has the right to seize the listed asset or property from the borrower.

While homes and cars are commonly used as collateral, it can be any other assets, rights, or interests in the borrower’s possession. Having a collateral on hand “secures” the lender’s stake in the arrangement and may result in a lower interest rate for the borrower.

On the other hand, an unsecured promissory note does not require collateral from the borrower as part of the contract. This means that if the borrower breaches the terms of the agreement, the lender may need to pursue legal action against the borrower to collect the amount owed.

Standard vs. Pay on Demand

While standard promissory notes outline a repayment timeline with a due date — in lump sum or in installments — a demand promissory note is more open-ended because it does not include specific payment terms about when the loan must be repaid. This means that the lender can serve a notice to the borrower at any time to repay the loan.

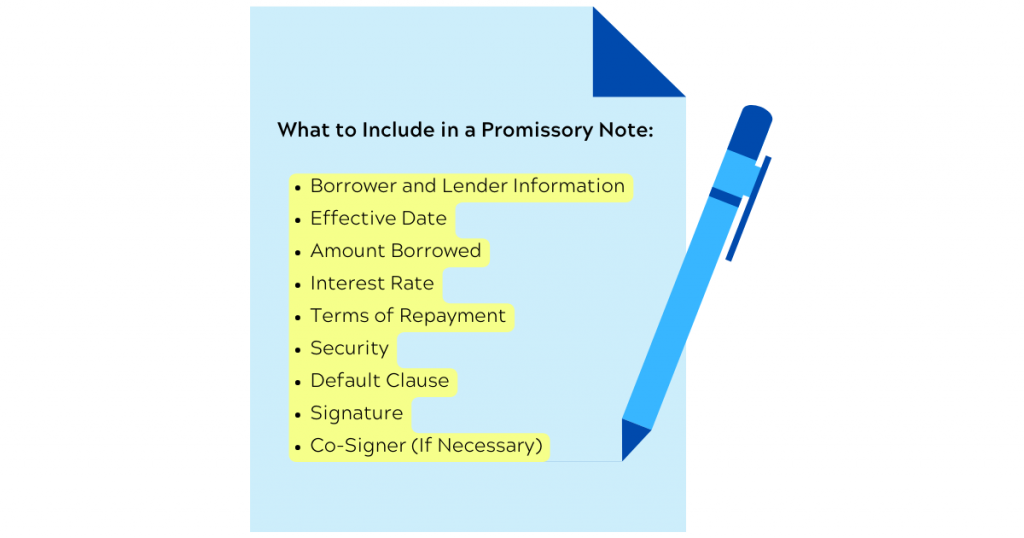

What to Include in a Promissory Note

States have their own versions of the Uniform Commercial Code, which governs the requirements of what must be included in a promissory note. While minor differences may be evident from state to state, standard sections include:

Borrower and Lender Information

This section identifies the two parties involved in the arrangement: the borrower and the lender. It provides their names and addresses.

Effective Date

It’s important to list the date of the promissory note becoming effective, as the repayment schedule can be relative to this date.

Amount Borrowed

The face value of the amount borrowed, also known as the “principal,” should be clearly stated.

Interest Rate

The interest rate is typically determined at the discretion of the lender, based on a number of factors: the borrower’s credit history, the size of the loan, whether security is being offered, and what state they’re in. The rate may be fixed or variable, meaning it can fluctuate overtime along with the market interest rate.

Every state has its own usury laws, which prohibit lenders from charging an excessive amount of interest on loans. Because it is governed and regulated by individual states, the allowed maximum interest rate may vary widely from one place to another. For example, California sets a cap at 10% for interest on personal loans, while Nevada’s allowed maximum rate is 36%.

Scroll to the bottom of the post to find a table with each state’s usury laws.

Terms of Repayment

This section outlines how the borrowed money is to be repaid by the borrower. Methods can range from a lump sum payment, monthly installments, or due on demand. Payment due dates and the amount due should be specified in the promissory note.

Security

It should be noted whether the borrower is offering collateral as a form of security for the lender. If this is the case, the asset or property in question should be named.

Default Clause

In the case that the borrower defaults on the loan, a promissory note typically includes clauses that state the lender’s rights in this scenario. This can include charging compound interest on an unpaid principal, acceleration of the final due date, and more.

Signatures

The borrower must sign and date the promissory note in order to legally seal the terms and conditions of the loan. The lender may also sign the document, but unlike loan agreements, it is not required.

Different states have different requirements with regard to witnesses and notary acknowledgement. While promissory notes generally don’t need notarization to be enforceable in court, it is often recommended in order to avoid any question over the authenticity of the document.

Co-Signer (If Necessary)

If the lender determines that the borrower’s credit history is not satisfactory enough to qualify for the loan, it may be necessary to include a co-signer—someone who can be held financially liable for the borrowed amount and interest if the borrower is unable to meet the terms of the promissory note.

Common Uses of Promissory Notes

Due to its general flexibility and simplicity, promissory notes are utilized frequently across various sectors by institutions and individuals alike. Below are the most common uses:

Master Promissory Note

A master promissory note (MPN) is used to borrow federal student loans for a period of up to 10 years. An MPN differs from a standard promissory note in that it allows a borrower to take out multiple loans over various academic years under the same terms and conditions as set forth in the original promissory note. By signing the MPN, the student is promising to repay the cumulative principal amount plus accrued interest and fees to the Department of Education.

For private student loans, the master promissory note does not apply.

Mortgage Promissory Note

A mortgage promissory note documents a loan that is used to finance the purchase of a home. Commonly referred to as a “mortgage note,” it acts as a legally binding promise from the borrower to repay the loan over the predetermined time span, typically ranging from 15 to 30 years.

Until the debt is paid in full, the lender typically holds the property as collateral. This means that in the case of missed or late payments, the lender is legally allowed to seize the home from the borrower and sell it—a process known as foreclosure.

Also, because a promissory note is a negotiable instrument, it is not uncommon for a mortgage lender to sell the note to a third party, such as a bank or a private entity. In such a case, all the terms and conditions of the mortgage contract would stay intact, other than a change in the legal holder of the note and who the repayment should be made to.

Promissory Notes for Personal Loans

A personal loan is typically a lump-sum amount borrowed from banks, credit unions, online lending platforms, or friends and family. Unlike the master promissory note or the mortgage note, a personal loan can be used for any purpose.

Promissory notes are commonly used for personal loans because the borrowed amount is generally smaller than other types of loans. And while institutional lenders typically set up recurring payments over the span of multiple years, lenders who have a more personal or informal relationship with the borrower may opt for a demand promissory note, which allows more flexibility in the repayment arrangement.

Corporate Promissory Note

When a business is officially incorporated, it is legally allowed to take out loans without personal liability to the people running the company. This means that on the promissory note, the company’s name would appear as the “borrower,” and an authorized person from the company would sign the note on its behalf. This method is commonly used in business to acquire short-term credit or financing from suppliers, financial institutions, and even individual investors.

A corporate promissory note is legally considered a “security” and must be registered with the SEC and the state securities regulator unless otherwise exempted.

Usury Laws By State

| State | Usury Rate | Laws |

| Alabama | 8% for written contracts, 6% for verbal agreements. | Ala. Code § 8-8-1 |

| Alaska | For loans less than $25,000, 5% above the 12th Federal Reserve District interest rate on the day the loan was made, or 10%, whichever is greater. If the amount is more than $25,000, there is no maximum rate. | Alaska Stat. § 45.45.010 |

| Arizona | No limit for loan agreements in writing. If not in writing, the rate shall be 10% per annum. | Ariz. Rev. Stat. Ann. § 44-1201 |

| Arkansas | Rate of interest may not exceed the maximum of 17% as established in the Arkansas Constitution, Amendment 89. | Ark. Code Ann. § 4-57-104 |

| California | Rate may not exceed 10% per year on loans for personal, family, or household purposes. For other loans for other purposes, the maximum is the higher of 10% or 5% over the amount charged by Fed. Res. Bank of San Francisco at the time loan was made. | Cal. Const. Article XV, § 1 |

| Colorado | For supervised loans general usury limit is 45%, and the maximum for unsupervised loans is 12%. | Colo. Rev. Stat § 5-12-103 and § 5-2-201 |

| Connecticut | The interest rate may not exceed 12%. | Conn. Gen. Stat. § 37-4 |

| Delaware | Not in excess of 5% over the Federal Reserve discount rate at the time the loan was made. | Del. Code. Ann. tit. 6, § 2301 |

| Florida | General usury limit is 18%, 25% on loans over $500,000. | Fla. Stat. § 687.03 and § 687.01 |

| Georgia | The default is 7% if no written contract is established. For written contracts, the maximum 16% on loans below $3,000, 5% per month on loans between $3,000 and $250,000, and no limit on loans above $250,000. | Ga. Code Ann. § 7-4-2 and § 7-4-18 |

| Hawaii | The default is 10% if no written contract is established, 12% is the general usury limit, and 10% is the limit on judgments. | Haw. Rev. Stat § 478-2, § 478-3, and § 478-4 |

| Idaho | Unless stipulated in a written agreement, the legal rate is 12%. The rate of interest on money due on court judgments is 5%. | Idaho Code Ann. § 28-22-104 |

| Illinois | The general usury limit is 9%. | 815 Ill. Comp. Stat 205/4 |

| Indiana | 8% in the absence of agreement, 25% for consumer loans other than supervised loans. | Ind. Code § 24-4.6-1-102 and § 24-4.5-3-201 |

| Iowa | The maximum interest rate is 5% unless otherwise agreed upon in writing, in which case, maximum is set by Iowa Superintendent of Banking (IA Usury Rates). | Iowa Code § 535.2(3)(a) |

| Kansas | The legal rate of interest is 10%; the general usury limit is 15%. | Kan. Stat. Ann. § 16-201 and §16-207 |

| Kentucky | The legal rate of interest is 8%, the general usury limit is 4% greater than the Federal Reserve rate or 19%, whichever is less. Any rate may be charged when identified in a contract in writing on a loan greater than $15,000. | Ky. Rev. Stat. Ann. § 360.010 |

| Louisiana | The general usury rate is 12%. | La. Rev. Stat. Ann. § 9:3500 |

| Maine | The legal interest rate is 6% (no usury limit mentioned in statutes). | Maine Rev. Stat., titl. 9-B, § 432 |

| Maryland | The legal interest rate is 6%, a maximum of 8% if a written contract is established. | Md. Code Ann., Com. Law § 12-102 – 103 |

| Massachusetts | The legal interest rate is 6% (unless a written contract exists); even if part of a contract, an interest rate over 20% is criminally usurious. | Mass. Gen. Law Ch. 107, § 3 and Ch. 271, § 49 |

| Michigan | 7% maximum if a written contract is established. Otherwise, the legal rate is 5%. | Mich. Comp. Laws § 438.31 |

| Minnesota | The legal rate of interest is 6%. For written contracts, the usury limit is 8%, unless for an amount over $100,000, in which case there is no limit. | Minn. Stat. § 334.01 |

| Mississippi | The legal rate of interest is 8%. Parties may contract for a rate of up to 10% or 5% above the Federal Reserve discount rate, whichever is greater. | Miss. Code Ann. § 75-17-1 |

| Missouri | The maximum interest rate is 10%, unless the market rate is greater at the time. | Mo. Rev. Stat. § 408.030 |

| Montana | 15% or 6% above the rate published by the Federal Reserve System, whichever is greater. | Mont. Code Ann. § 31-1-107 |

| Nebraska | The maximum interest rate is 16%. | Neb. Rev. Stat. § 45-101.03 |

| Nevada | Parties may contract for a rate up to the lesser of 36% or the maximum rate permitted under the federal Military Lending Act. | Nev. Rev. Stat. § 99.050 |

| New Hampshire | There is no legal limit on interest rates. It is unclear whether an exorbitant rate could be considered “unfair” under the New Hampshire Consumer Protection Act and hence unlawful. | N.H. Rev. Stat. Ann. § 336:1, § 358-A:2 |

| New Jersey | 6% without a written contract, 16% maximum if a written contract is established. | N.J. Stat. Ann. § 31:1-1 |

| New Mexico | 15% maximum in the absence of a written contract. | N.M. Stat. Ann. § 56-8-3 |

| New York | The legal rate of interest is 6%, the general usury limit is 11.25% | N.Y. Gen. Oblig. § 5-501 and N.Y. Banking § 14-A |

| North Carolina | For loans less for less than $25,000, the maximum is the amount announced on the 15th of each month by the North Carolina Commissioner of Banks. For loans greater than $25,000, the parties may agree in writing to any amount. | N.C. Gen. Stat. § 24-1.1 |

| North Dakota | For written contracts for loans less than $35,000, the maximum rate is 5.5% above the current maturity rate of Treasury Bills for the six months preceding the issuing of the loan, or 7%, whichever is greater. | N.D. Cent. Code § 47-14-09 |

| Ohio | The maximum interest for written contracts for loans of amounts less than $100,000 is 8%. | Ohio Rev. Code Ann. § 1343.01 |

| Oklahoma | The parties may agree in a written contract to any rate so long as it does not violate other applicable laws. | Okla. Stat. tit. 15, §266 |

| Oregon | The legal interest rate is 9%, but the parties may agree to different rates in a written agreement. Business and agricultural loans have a maximum of 12 percent or five percent greater than the 90-day discount rate of commercial paper. | Or. Rev. Stat. § 82.010 |

| Pennsylvania | For loans less than $50,000, the maximum rate is 6%. | 41 Pa. Cons. Stat. Ann. § 201 |

| Rhode Island | The maximum interest rate is the greater of 21%, or the domestic prime rate as published in the Wall Street Journal plus 9%. | R.I. Gen. Law § 6-26-2 |

| South Carolina | Unsupervised lenders may not charge a rate above 12%. No lender may charge a rate above 18%. | S.C. Code Ann. § 37-3-201 |

| South Dakota | No limit if a written agreement is established, 12% if no agreement exists. | S.D. Codified Laws § 54-3-4 and § 54-3-16(3) |

| Tennessee | The maximum rate is 10% unless otherwise expressed in a written contract. | Tenn. Code Ann. § 47-14-103 |

| Texas | The parties may agree in writing to a maximum rate up to the weekly ceiling as published in the Texas Credit Letter. If no agreement exists, then the maximum is 10%. | Tex. Fin. Code Ann. § 302.001(b), §303.002 |

| Utah | The maximum rate of interest is 10% unless the parties agree to a different rate in a written contract. | Utah Code Ann. § 15-1-1 |

| Vermont | The rate of interest is 12% except in certain circumstances as provided in subsection (b) of § 41a. | Vt. Stat. Ann. tit. 9, § 41a |

| Virginia | The legal rate of interest is 6%. With a contract in place, the maximum interest rate is 12%. | Va. Code Ann. § 6.2-301 and § 6.2-303 |

| Washington | The maximum rate of interest is 12% or 4% points above the average bill rate for 26-week treasury bills in the month before the loan was made. | Wash. Rev. Code § 19.52.020 |

| Washington D.C. | The maximum rate of interest is 24% for written contracts and 6% for verbal contracts. | D.C. Code, Title 29, Chapter 33 |

| West Virginia | The legal interest rate is 6% but parties may agree to a maximum of 8% in a written agreement. | W. Va. Code § 47-6-5 |

| Wisconsin | The legal rate of interest is 5%. Parties may agree to a different rate in a written agreement, subject to limitations that depend on the identity of the lender. | Wis. Stat. § 138.04 |

| Wyoming | The rate of interest is 7% if no agreement is established in a written contract. Otherwise, parties may agree to a higher rate. | Wyo. Stat. Ann. § 40-14-106 |