Even before the coronavirus pandemic, purchases of life insurance were increasing, and that trend has since accelerated. According to one study, overall application numbers are up 5.5 percent this year over 2020, which was already the year of greatest interest in purchasing life insurance policies in at least a decade. Age groups under 70 are now more likely to purchase life insurance, but the fastest growth in recent years has been among those in their 30s and 40s.

Wondering if you’re missing out? Is life insurance coverage a good idea for you? In this article, we’ll take a look at how life insurance works, the different kinds of policies available, and how to get the right policy for you — including recent changes that have made obtaining coverage easier.

Table of Contents

- How Life Insurance Works

- Types of Life Insurance

- Steps to Choosing a Policy

- State Life Insurance Laws

- More Resources

- Sources

How Life Insurance Works

Life insurance is a contractual arrangement in which a client makes payments over a period of time to an insurance provider, with the expectation that the insurer will pay money when the client dies to people the client has chosen. The periodic payments are usually called “premiums” and, as with a will, the people who will receive money when the client dies are called “beneficiaries.” Once the terms are agreed to, the contract is known as a “policy” and the money that is paid out is called a “death benefit.”

Most people purchase life insurance to cover both immediate costs their families could face — such as decedents’ pending debts, medical bills, and funeral expenses — as well as ongoing expenses they would have contributed to when alive, such as rent or mortgage payments, and education costs for children.

- Beneficiaries – people who receive money when the client dies

- Policy – the life insurance contract

- Death benefit – money that is paid out to beneficiaries

- Premiums – periodic payments

What is Underwriting?

Life insurance companies base their premiums and coverage availability on many factors, but broadly, they are trying to gauge how likely the client is to die over certain periods of time. To do this, insurance companies use what is known as “Underwriting” also called “Medical Underwriting.”

There are two types of medical underwriting: full and simplified.

- Full medical underwriting typically involves detailed questionnaires, lab work, and physical exams. It can take longer to get approved, but insurers are more likely to offer better deals when they have more details about a client.

- Simplified medical underwriting is most associated with “no exam life insurance.” Medical exams are not required, and questionnaires are not as invasive as they are with full underwriting. It is much more efficient and has a quicker turnaround, but coverage may be more limited because an insurer doesn’t have a detailed background of the client’s health and personal history.

For many years, the difficulties associated with full underwriting likely discouraged some people who might have been interested in life insurance from pursuing policies. This has begun to change recently and may explain the increasing popularity of life insurance among younger people. Companies like Afficiency are using technology to make more efficient assessments of health profiles so that potential clients can do everything needed to obtain a policy without a medical exam or leaving their homes.

Riders

Riders are additional features that can be purchased from an insurer to be added to an existing policy. They are like toppings on a pizza: Little, desirable extras that can be added for a small fee.

There are many different kinds of riders. Here are some of the most common:

- Guaranteed Insurability: This allows you to purchase an expanded policy from your current insurer at some point in the future without having to undergo an additional medical examination.

- Long Term Care Rider: This rider provides for monthly payments in the event that the client is alive, but requires long-term care or medical treatment. It’s possible to obtain separate coverage for such a possibility, but it may be more affordable as a rider on an existing life insurance policy.

- Accelerated Death Benefit Rider: This rider only applies to policyholders who are diagnosed with a terminal illness. It permits them to withdraw funds from their death benefit to pay for associated medical bills. Some examples are a chronic illness rider and a long-term care rider.

- Return of Premium Rider: This rider adds a clause that awards the client a full or partial refund for paid premiums if they ever choose to cancel their policy.

Types of Life Insurance

Insurance companies offer many different types of policies. Policies can vary based on the length of time covered, the benefits offered, who is paying and who is covered.

Term vs. Whole Life Insurance

The most distinction you will encounter in the life insurance industry is between policies that have a finite term, and those that do not. A “term” life insurance policy provides coverage only for a specific period of time. “Whole life” insurance is the most common type of permanent coverage life insurance, which are policies good from the day they are activated until the death of the client.

Permanent Life Insurance

A “permanent” life insurance policy provides lifetime coverage to the client. This means the agreement itself is “in perpetuity,” or doesn’t have a formal end date. The client continues paying premiums until passing away or canceling the policy. Because permanent insurance policies are more likely in a death benefit payout by the insurer, they tend to be more expensive than term policies.

Most of the time, permanent life insurance policies come with an investment account called a “cash value.” This is a small amount of funds set aside from each premium payment that a policyholder can borrow against or even make withdrawals from, both tax-free. Any cash value that remains when a client dies is managed differently depending on the type of policy. If a client has any outstanding withdrawals or loans, those amounts are usually deducted from the death benefit before it is paid out.

There are four (4) types of permanent coverage life insurance policies:

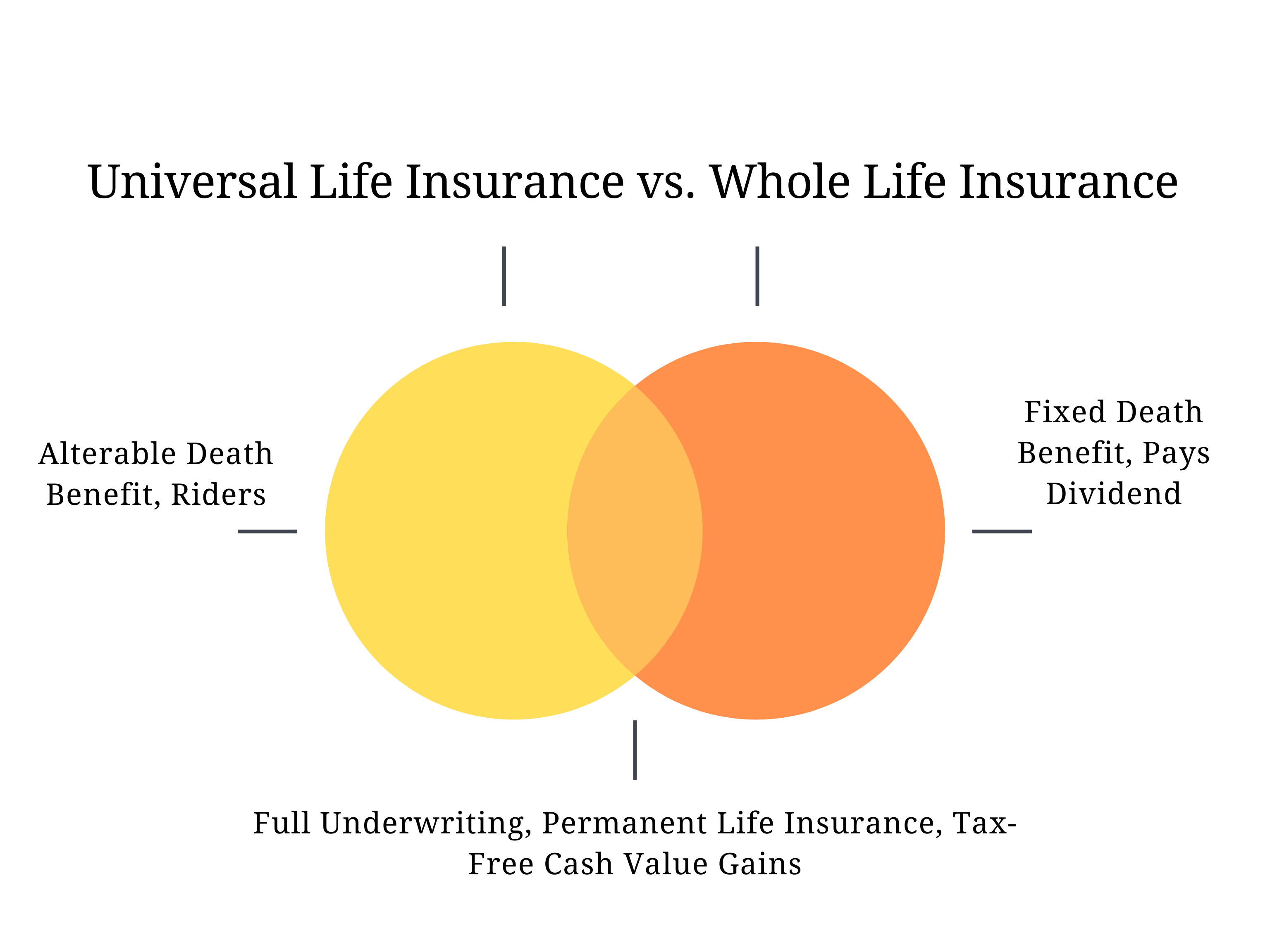

Whole Life Insurance – Most Popular

A “whole” life insurance policy has a fixed death benefit and a cash value that grows tax-free at a guaranteed rate of return. Like stocks, these policies may periodically pay out a portion of the insurer’s profits, called a “dividend.” The dividend can be used to reduce premium amounts or add funds to the cash value.

If you are purchasing a life insurance policy at a relatively young age, and want to buy life insurance lasting for thirty (30) years or more, this may be the policy for you. These policies can be incorporated into your estate planning and may be used, for example, to fund a trust, or help your heirs pay estate taxes.

Whole life insurance policies usually have the most extensive underwriting process of any type of policy. Insurers may consider any of the following factors when determining a potential client’s death benefit and premiums:

- Age;

- Alcohol use;

- Credit;

- Criminal record;

- Current health conditions;

- Dangerous activities/hobbies/occupations;

- Driving record;

- Drug use;

- Family health history;

- Gender;

- Height;

- Nicotine use;

- Past health conditions; and

- Weight.

Burial Insurance

Burial insurance is a policy targeted specifically at a client’s end-of-life expenses, such as funeral costs, medical bills, and outstanding debts. They usually have smaller death benefits, ranging from $5,000-$25,000.

Survivorship Life Insurance

Survivorship life insurance is also known as “second to die” life insurance. They insure two people, typically a married couple or a couple in a civil union, and pay out to another party, such as a child. In these instances, the death benefit does not pay out until both clients have passed away. These policies may also be incorporated into estate planning. However, the second person must continue making payments after the first has died in order for the policy to remain in effect, so it’s important to think about the ability of both parties to pay the premiums should the other die.

Universal Life Insurance

A universal life insurance policy is like a whole life insurance policy, but more flexible. Once you’ve signed up and begun paying premiums, you can modify the premiums, or the death benefit, and change the terms of paying either.They also typically offer different possible riders to include as addendums to the policy agreement. The benefit payout and cash value gains are tax-free. However, this type of policy usually does require full underwriting. Like whole life insurance, universal life insurance can be useful for people envisioning larger, long-term estate plans. The ability to modify premiums or benefits can be a benefit, but can also impose significant costs, meaning that the policies may be best for people who are more financially sophisticated.

There are five (5) subcategories of Universal life insurance:

- Cash Accumulation UL: This policy specifically builds cash value early and fast.

- Current Assumption UL: In these policies, the death benefit is not guaranteed. The cash value of premiums grows (or declines) based on a “crediting rate” set by the insurer. The policies can be cheaper, and can be modified, but can inadvertently lapse for those without a good grasp of finance.

- Guaranteed Universal Life (GUL): This is the most restrictive universal policy and usually the least expensive. Premiums and death benefits are fixed, and cash values are often low if there are any at all. Be warned; an entire policy often cancels with just a single missed payment.

- Indexed Universal Life (IUL): This also has adjustable death benefits and premiums and a cash value tied to a stock index, like the Nasdaq-100 or the S&P 500. But proceed with caution, as the Center for Economic Justice warned in July 2020 that these types of policies could be deceptive or misleading.

- Variable Universal Life (VUL): This policy has adjustable death benefits and premiums, and a cash value tied to sub-accounts containing stocks and bonds.

Term Life Insurance

The defining feature of term life insurance is that, if you do not die during the term of the policy, there is no death benefit. Because the risk of having to pay out is lower for a term policy, it has fixed premiums, and the premiums tend to cost a bit less than permanent policies.

Premiums are usually based on the amount of coverage, age, gender, and medical history. They can last anywhere from 10-30 years but also sometimes allow for guaranteed renewability on an annual basis. Sometimes they can even convert into permanent policies if the client’s wishes change. If the client dies during the term period, the death benefit is paid to their designated beneficiaries tax-free.

There are three (3) main types of term life insurance:

- Decreasing Term – The death benefit decreases annually, to eventually expire at $0.00 at the end of the term, but premiums don’t decline. Decreasing term policies are a good choice for those beneficiaries who would face an amortized debt, like a mortgage, that can be paid off for less money overall by paying more upfront.

- Increasing Term – The reverse of a decreasing term policy. Here, the death benefit increases over time. These policies can be a good hedge against inflation.

- Family Income Benefit – Here, the death benefit is not paid out as a single lump sum, but in installments that serve as “income” for beneficiaries. The nature of the installments will be determined when creating the policy, and the installments will be tax-free. Some companies may offer lower premiums on family income policies because staggered payments are easier for insurers to plan for.

Other Types

Less common than whole and term, there are other types of life insurance policies.

Group Life Insurance

Each of the policies discussed above applies to insurance purchased by an individual (or a couple, in the case of survivorship insurance) from an insurer. Group life insurance, on the other hand, is purchased on behalf of a group of people. It is usually offered to employees of a company as a benefit of their employment, similar to health insurance or a 401(k). It’s sometimes also known as “basic group life insurance.” The application process is generally much simpler and coverage is lower; it may even be free, depending on an employer’s contributions. In the case of group life insurance offered through work, all employees are usually allowed to opt-in, and a medical exam or questionnaire is not required to participate.

The main downsides to a group policy versus an individual are:

- Coverage is often lower than in an individual plan;

- Employers usually contract with a single company, so the employee doesn’t choose their provider;

- The policies don’t carry any cash value;

- The policies tend to favor younger employees; and

- The policies don’t stay with the employee if they ever leave the company unless the provider has an option to convert the group term policy into an individual permanent one.

Ultimately, if a group policy is either free or very inexpensive to opt-in to, it’s probably worthwhile to do it and then find out if the provider offers what is known as supplemental life insurance.

Supplemental Life Insurance

A supplemental life insurance policy functions just like a primary policy but operates in addition to a separate policy held by the client. Supplemental policies are often used by people who have a group policy as a benefit of their employment, but who want more coverage than the group policy provides. Anyone, however, is eligible for supplemental insurance, and people purchase the policies for any number of reasons, such as a job change, inflation, or retirement.

Steps to Choosing a Policy

Step 1 – Decide between a term or permanent policy.

Step 2 – Choose a coverage amount by adding up all of the expenses that will need to be covered, minus any assets, savings, or other life insurance policies held by the policyholder.

Step 3 – Get several quotes from a few different insurance agencies.

Step 4 – Choose the person, people, or entity that you want to claim the death benefit when the time comes. It’s also wise to name one or two backup beneficiaries in case the first one passes away before you.

Step 5 – Apply for the policy you’ve chosen.

Step 6 – Undergo a medical underwriting medical exam, if required.

Step 7 – Wait for approval. The processing time can take anywhere from one day to one month, depending on the type of insurance.

Step 8 – When the time comes, the beneficiary of the policy can reach out to the insurance company to claim the death benefit. They usually need to provide a certified copy of the policy holder’s death certificate. Claims should be paid out within thirty (30) days of the beneficiary submitting the required paperwork.

Choosing an Insurer

There are two important factors to consider when deciding which life insurance provider to purchase a policy from.

First, gauge the company’s financial strength by researching its credit rating. A good credit rating provides confidence that the company has the financial means to pay out its claims. The four most popular life insurance credit agencies are:

- Standard & Poor’s (Top Rating: “Very Strong” A++);

- Moody’s Investors Service (Top Rating: “Highest Quality” Aaa);

- A.M. Best (Top Rating: “Superior” A++); and

- Fitch Ratings (Top Rating: Exceptionally Strong” AAA).

Second, always look up reviews and ratings regarding a company’s customer relations. It’s also worth asking friends, family, and colleagues about their customer service experiences with their life insurance providers. Working with a company that values customer service will provide some peace of mind that loved ones will be treated with respect when it’s time to submit their claims.

State Life Insurance Laws

More Resources

- Best Term Life Insurance Companies of November 2021: A guide to the top life insurance providers from the credit agency Best Term.

- MIB Life Index: This measures application activity in the life insurance industry and is based on the underwriter searches on the MIB Code Service database.