Even if you’re a safe, cautious driver, accidents can happen to anyone. Several millions of crashes occur every year on U.S. roads and highways. Collisions between bicycles and motor vehicles are also on the rise.

If you’re involved in an accident involving an automobile, whether you’re a pedestrian, cyclist, or motorist, there are processes and policies you should be aware of. The right preparation and follow-up can minimize any harm caused by a car accident.

Table of Contents

Being Prepared

Nobody wants to plan for an accident, but in case things do go wrong, preparation can make the outcome a lot less stressful. It’s important to be aware of insurance requirements in your state so that you are protected legally and financially if an unfortunate situation comes to pass.

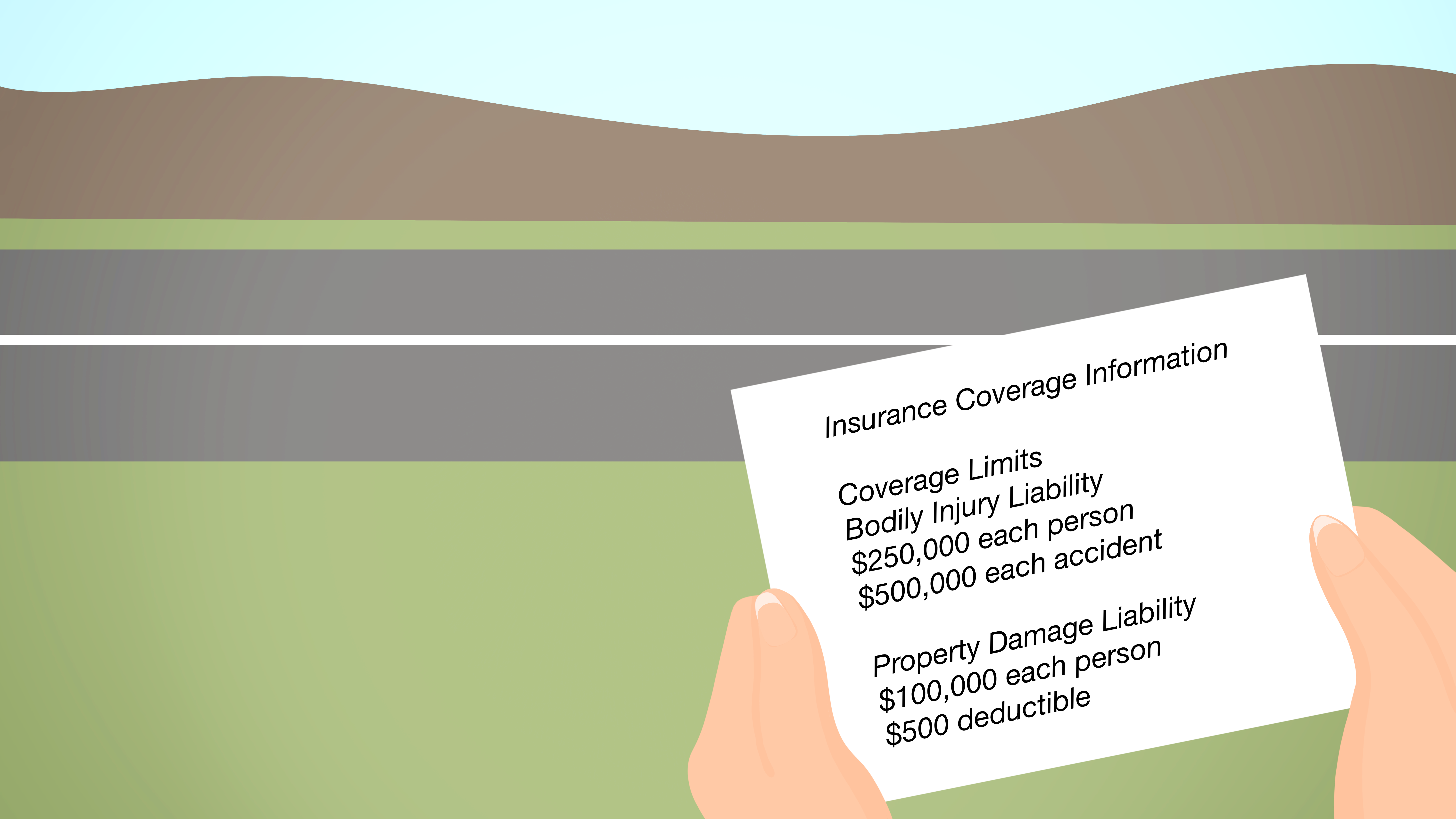

Minimum Auto Insurance

Each state sets its own requirements for insurance coverage. When it comes to car insurance, there are multiple kinds of coverage that apply to different situations. States usually have rules about the minimum coverage every driver must have.

Some of the most common types of required auto insurance are:

- Bodily injury liability – helps pay for medical bills, lost wages, or other expenses of others injured or deceased in an accident

- Property damage liability – covers damage caused to other vehicles or other property, such as fences and buildings

- Personal injury protection – covers injury of the insured party and their passengers

- Uninsured/underinsured motorist coverage – pays for costs incurred in an accident caused by a driver with inadequate or no insurance

You can always go over the minimum insurance requirements to reduce your chances of needing to pay out of pocket for an incident. However, it’s important to ensure your policy is at or above the minimum for the state in which you reside. Your policy will cover you everywhere within the United States.

Car Insurance Requirements by State

| State | Minimum Coverage Requirements |

| Alabama |

|

| Alaska |

|

| Arizona |

|

| Arkansas |

|

| California |

|

| Colorado |

|

| Connecticut |

|

| Delaware |

|

| Florida |

|

| Georgia |

|

| Hawaii |

|

| Idaho |

|

| Illinois |

|

| Indiana |

|

| Iowa |

|

| Kansas |

|

| Kentucky |

|

| Louisiana |

|

| Maine |

|

| Maryland |

|

| Massachusetts |

|

| Michigan |

|

| Minnesota |

|

| Mississippi |

|

| Missouri |

|

| Montana |

|

| Nebraska |

|

| Nevada |

|

| New Hampshire |

|

| New Jersey |

|

| New Mexico |

|

| New York |

|

| North Carolina |

|

| North Dakota |

|

| Ohio |

|

| Oklahoma |

|

| Oregon |

|

| Pennsylvania |

|

| Rhode Island |

|

| South Carolina |

|

| South Dakota |

|

| Tennessee |

|

| Texas |

|

| Utah |

|

| Vermont |

|

| Virginia |

|

| Washington |

|

| Washington D.C. |

|

| West Virginia |

|

| Wisconsin |

|

| Wyoming |

|

What if the Driver at Fault Is Not Insured?

In the United States, one in eight drivers is not insured. If you happen to be in an accident caused by an uninsured or underinsured driver, they might not be able to pay for the damage caused.

There is a special kind of insurance policy to pay for medical bills, lost wages, property damage, and other costs in this situation. Some states require uninsured motorist coverage, and some insurance policies include it automatically.

At the Scene

First things first: stop, pull to the side of the road if you can do so safely, and immediately call 911 if anyone is injured. It’s best to err on the side of caution and call for medical attention if you think you or someone else may need it. First responders can give you a thorough medical evaluation on the spot.

Notify the police of the incident, regardless of the severity. The officers will take down statements from each participant and witness, which can play an important role in any ensuing legal action.

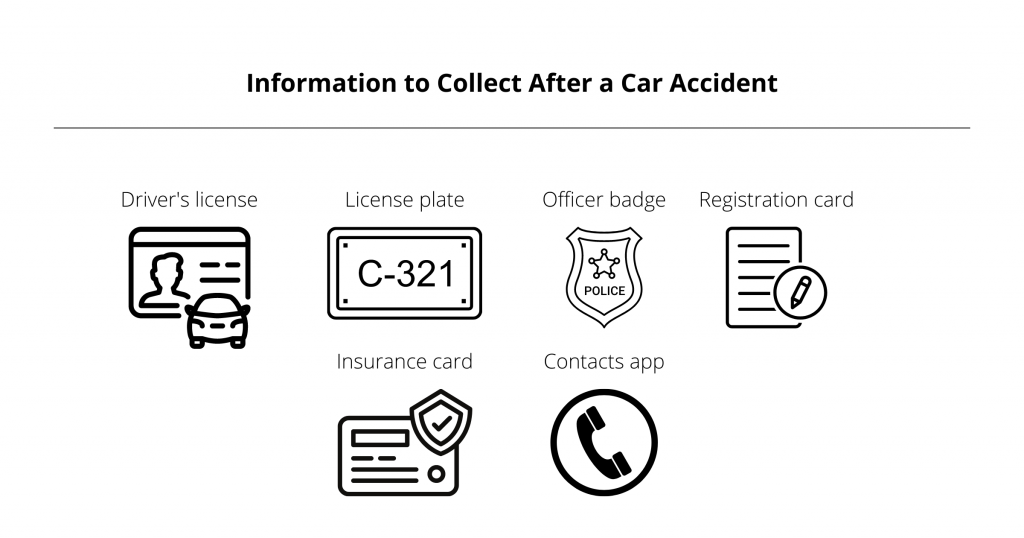

Information to Collect After an Accident

It may be difficult to focus after a car accident, but it’s even more difficult to track someone down after the fact if you do not exchange information then and there. The following information should be gathered from all involved parties:

- Contact information (including from any witnesses)

- License plate numbers

- Vehicle identification numbers

- Driver’s license numbers

- Insurance information from all involved parties

- Police officer information and badge numbers

Additionally, snap a few photos or record video clips to document any property damage. Your insurance company or legal team may want to reference these later on.

Avoid signing any statements, unless required by law enforcement. Do not attempt to make a settlement agreement on the spot. It’s best to simply collect basic information and let the insurance claims process take care of the rest.

At the same time, if another person on the road is in need of help, do so immediately. If the accident does lead to a dispute in court, offering to help after an accident, including offering to help pay medical bills, is generally not admissible to show that the person offering is liable for harm caused by the accident.

What to Do in a Hit-and-Run

Recent data reveal an increase in the occurrence of hit-and-run incidents, in which one driver involved in a collision takes off without stopping. This is considered a criminal offense in most cases and can result in serious consequences, including revocation of the driver’s license.

If you’re the victim of a hit-and-run accident, document as much information as you can recall about the perpetrator, their vehicle, and the circumstances surrounding the crash. Call the police and relay to them the details of:

- The vehicle (make, model, color)

- The license plate (state, number)

- The driver’s appearance (age, gender, build, clothing)

- How and where the accident happened

Once you’re in a safe place and have filed a police report, call your insurance company. Many policies include coverage for damage caused in hit-and-run accidents, and some states make it illegal for providers to increase premiums after this type of incident.

Staged Accidents

Unfortunately, insurance scams can be a lucrative crime. Staged accidents occur when drivers intentionally cause collisions in an attempt to collect insurance payouts. Staged collision fraudsters strategically create accidents, then place blame on the innocent party and file insurance or legal claims against them.

You can protect yourself against staged collision fraud. Make sure to:

- Research the tactics employed in staged accidents so you know what to look out for

- Document every detail of the collision, including photo and video evidence of any damage

- Steer clear of doctors, attorneys, tow truck drivers, or other presumptive “professionals” who show up at the scene unexpectedly

- Get a police report and take down the officer’s information

Kidnappers may also stage minor accidents to lure drivers off the road and out of their vehicle. If you can, be sure to pull over in a public, well-lit area. Always trust your gut, call the police to the scene, and, if something seems suspicious, remain in your vehicle with the doors locked until law enforcement arrives.

Following an Accident

Depending on the circumstances surrounding an accident, the extent of the damage, and whether or not legal action is initiated, the insurance claims process can last for months or even years after the incident. Armed with the proper steps to follow, you can navigate this process confidently and get the maximum payout.

How Car Accident Claims Work

There are three different situations you might find yourself in when seeking to be made whole following an accident.

-

- Third-party claims. If the other driver was clearly at fault, you can contact their insurance company to file a claim.

- Claims with your own insurance. If the other driver was at fault but lacks adequate insurance, you can make a claim with your own company (provided that your policy includes this type of coverage).

- Choosing not to file a claim. If you were responsible for the damage, it may not be worthwhile to seek an insurance payout as your premiums can go up as a result. Consider this when evaluating repair costs.

If you are filing an insurance claim, contact the company immediately to notify them of the accident. They may request documentation or take a statement from you. If you are not sure about the status of your case, follow up every two to three weeks to make sure things are on track.

Each insurance company handles claims differently. After the appraisal process, they will commonly offer compensation at either the amount needed to repair the vehicle or the market value of the vehicle — whichever is lower.

You don’t have to settle for the offer from the insurance company. If you think you are owed more than the company offers you, it may be time to hire an attorney.

Should You Call a Lawyer After a Car Accident?

Do you need a lawyer after a car accident? In minor collisions where damage was minimal and no injuries were sustained, securing legal representation may not be necessary. But an attorney can help you win fair compensation if you’re facing significant difficulties as a result of a crash.

In some instances, particularly when the parties in an accident dispute who is at fault, your insurer may hire a lawyer on your behalf. You have the legal right to seek your own legal counsel, but if you do decide to get your own attorney, you should let your insurance company know.

A lawyer can negotiate on your behalf to ensure the full extent of damage is accounted for in the settlement. This can include property damage, lost wages, and medical bills, all of which can be extremely costly. If an agreement is not reached, they can file a personal injury lawsuit and take the matter to court.

Many personal injury lawyers work on contingency, meaning their compensation is a set percentage of the end settlement. This means you won’t need to pay for representation up front, and, if you don’t get any money, you won’t owe anything.

If you’re considering retaining a personal injury lawyer, contact them as soon as possible after the incident. The sooner they can begin building your case, the stronger it will likely be. Moreover, states usually impose a statute of limitations on the timeframe in which you can bring a lawsuit of this nature.

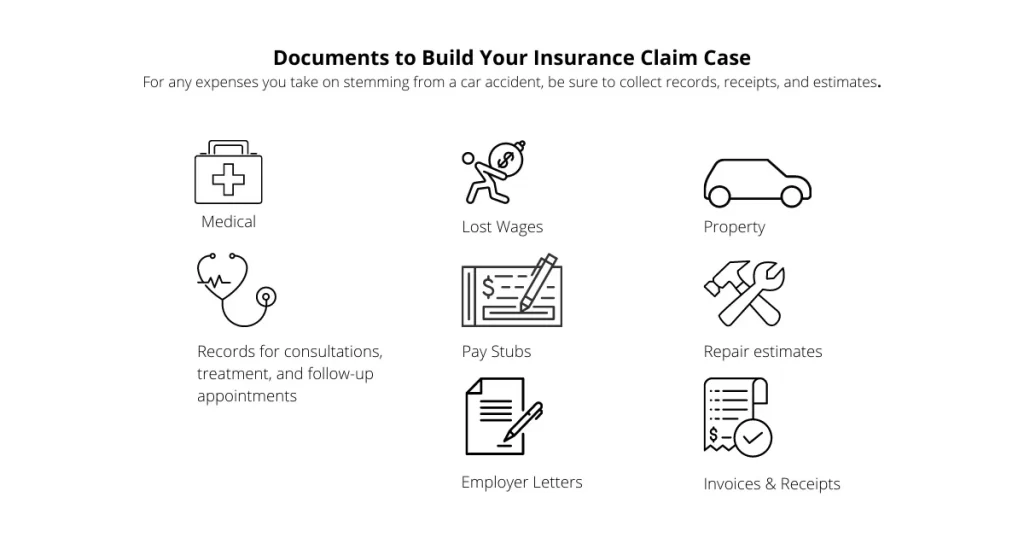

Recovery and Restitution

If you were physically injured in an accident, make your recovery a top priority. Find a qualified physical therapist or appropriate practitioner and stick to the program.

Not only does this increase your chances of getting back to normal life—it also maximizes the damages you can seek. Being diligent in your treatment will help ensure that the full consequences of the accident are reflected in your claim.

Taking the time you need to recover is an important part of mitigating further issues down the road. If this means taking time off from work, you can seek compensation for lost wages as part of your case.

If your car, bicycle, or other property was damaged in the accident, you may need to pay out of pocket to get repairs or replacements in a timely manner. The insurance payout or legal claim will settle this later.

In the process of restoring yourself and your property, be sure to hold onto any and all documentation that will help substantiate the claims made in your case. These may include:

- All medical records for consultations, treatments, and follow-up visits

- Documentation supporting lost wages

- Itemized receipts for any repairs or replaced property

Your insurance claim should also account for projected future lost wages and medical bills, if applicable.

Issuing Demand Letters

Once you’ve gathered all the information needed to submit an insurance claim, the next step is submitting a demand letter. Ideally, this letter will facilitate a settlement or open a negotiation that ends in an agreeable resolution outside of court.

Demand letters should describe the incident and detail all expenses incurred as a result. They should also set forth a total combined amount owed.

If you have an attorney, they will handle the demand letter process. You can also write a car accident demand letter or personal injury demand letter on your own if you are not working with legal representation.

Collecting Your Payout

Once a final settlement agreement or court judgment is reached, the insurance company (or defendant) is liable to pay you the full amount. However, the terms of the payout might vary. You may receive your payout in multiple installments, for example. If you’re working with a law firm, they might process the checks on your behalf and pay you after taking their cut.

FAQ

Will an accident impact my insurance premiums?

Whether an accident impacts your insurance premiums will depend on your policy and the details of the incident. Usually, your premiums will go up if you are found to be at fault for the accident. This can be a significant expense that accrues over time, which is why it’s not always worthwhile to file insurance claims for an accident you caused.

Can a car accident affect my credit score?

No. Car accidents are not reported to credit bureaus. If you’re in a precarious financial situation because of an accident, however, your credit might be affected indirectly.

Are car accident settlements taxed?

Car accident settlements are not typically taxed as income. However, compensation for lost wages may be taxed. Check the IRS guidelines and consult a tax advisor to find out if your settlement is taxable.

Are car accident settlements public record?

Settlement agreements are kept between the involved parties and are not accessible to the public. However, if a case is brought to court, it will likely become public record. This is something to consider when determining whether to bring your case to trial.